Are you a risk taker or a gambler when you trade? Definitely you may have been a victim of "hyped" stocks in the market, it would be best if you were able to start to ride the stock during its early stages before big players will start to dump their shares before you end up "ipit".

You may find community of traders in different social media sites trying to cheer their own stock to lure other investors/traders to jump in and exchange in a prison cell in the market.

You may have read about sentiments from other fellow traders who wants to get out from their current stocks that is why they do every means to get you into the hype.

If you happen to buy "hyped" stocks then welcome to the market's prison cell (ipits) unless you were able to managed to escape early before the sell off (buhos) took place.

If you happen to buy "hyped" stocks then welcome to the market's prison cell (ipits) unless you were able to managed to escape early before the sell off (buhos) took place.

How would you know if it's a "hype" in the first place? It's so easy whenever you read these lines prompts you to buy...

"Road to ₱100". "Road to ₱1" etc

"Bili na murang mura"

"Bili na mga suki presyong Divisoria"

"Buy now"

"Fly me to the moon"

"Flying high"

"Sakay na"

"Aakyat na to"

"Pwede pa humabol"

"Fresh na fresh bili na kayo"

"Good buy at ₱0.49"

"Position na"

"All in ako dito!"

"Fasten your seat belts"

"Buy na thank me later"

"Sanla ko bahay ng kapitbahay namin!"

"Sanla ko bahay ng kapitbahay namin!"

while these sample lines may prompt you to sell...

"Babagsak na yan"

"Abang sa Dos"

"Piso ang usapan"

"Takbuhan na"

"Benta nyo na"

"Balikan kita kapag nasa 9ish level"

"Ayan na nagkabuhusan na"

"(Stock) Bulok"

Again these are just samples above that you can note of as to what I observed for the past years in the market but before you become a prey to those market movers like the big players, always base your decisions on what the chart tells you, add some fundamentals with some gut feeling if you wish.

Every one has its own reactions to every price movements, some are sensitive some are high risk takers or some are low risk takers.

All of us want to make some money from the market and wants our capital grow, so it's just a matter of exchanging our own money with other traders depending on who will be patient to wait and to those who can not.

You can also check if it's a "hyped" stock when sudden price increase without any catalyst/news that pump the price as it may be moved by some insiders trying to wait for some newbies to jump in without any great volume due to some cross tradings done which are not recorded publicly.

That is why it can not be helped when you see traders trying to cheer their own stocks with too much exaggeration of false claims just to attract others to buy or sell.

If you read self proclaimed gurus telling you to buy a particular stock try to use reverse psychology, they might be telling you to buy but actually they are already preparing to sell, same goes when they told you to sell as they already set their buy orders on GTC.

My personal take if you should avoid or not? If you are a high risk taker then you can play "hyped" stocks as long as you know your own entry and exits, follow the big players (institutions) if you can see them accumulating you can go with the flow and if they start to dump then do the same before you regret later, just check from your broker's time and sales section if needed.

Trading "hyped" stocks needs a great control for your GREED or as much as possible should not be applied at all, if you were able to ride the 1st stages of accumulation by some big players sell your shares when you already have some profits and do not wait and sell to a price when nobody will be buying at that price level that you asked for.

Forgot the name of the trader who told me once... "Why do you wait to sell your shares when nobody wants your price while you can sell your shares to a price they are willing to pay but still giving you some profits?" does that make sense or ring a bell?

Exit early for "hyped" stocks this is your way to minimize risk while taking home some profits but if you are brave enough to follow your instincts and know when to dump your shares before sell down happens then the better.

Let's try to take the cases of the following stocks...

Trading "hyped" stocks needs a great control for your GREED or as much as possible should not be applied at all, if you were able to ride the 1st stages of accumulation by some big players sell your shares when you already have some profits and do not wait and sell to a price when nobody will be buying at that price level that you asked for.

Forgot the name of the trader who told me once... "Why do you wait to sell your shares when nobody wants your price while you can sell your shares to a price they are willing to pay but still giving you some profits?" does that make sense or ring a bell?

Exit early for "hyped" stocks this is your way to minimize risk while taking home some profits but if you are brave enough to follow your instincts and know when to dump your shares before sell down happens then the better.

Let's try to take the cases of the following stocks...

Disclaimer: Sample charts provided are for educational purposes only.

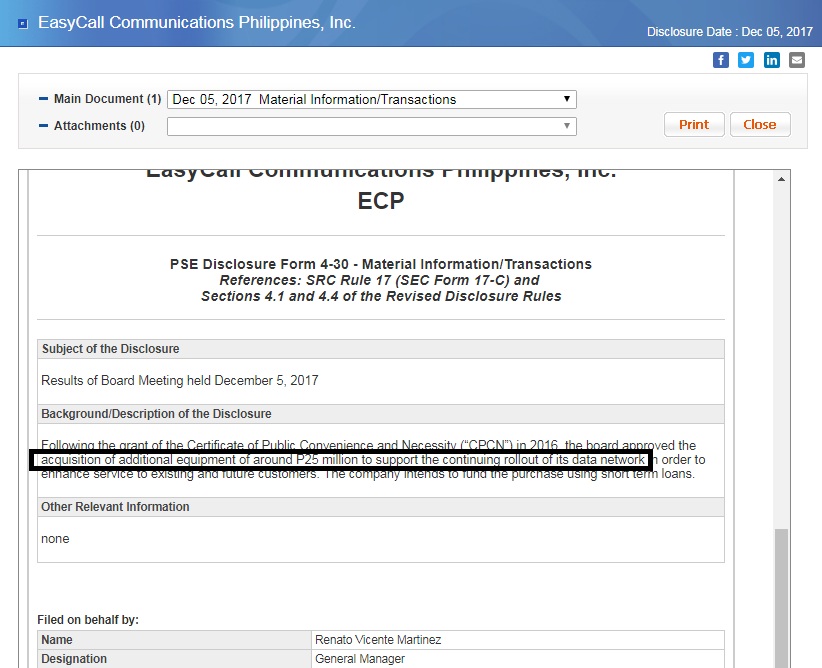

STOCK: ECP (EasyCall Communication Philippines)

During the 3rd telco player news, out of nowhere ECP (EasyCall Communication Philippines) started to make some rallies when it was just trading below ₱5 level before it made a sudden movement with low volume which initiated retailers to join the band wagon right away the following days causing gap ups before the sell down took place.

During the 3rd telco player news, out of nowhere ECP (EasyCall Communication Philippines) started to make some rallies when it was just trading below ₱5 level before it made a sudden movement with low volume which initiated retailers to join the band wagon right away the following days causing gap ups before the sell down took place.

|

| chart_from_investagrams_ECP_price_movements |

You may consider the AOTS formation but the sudden price increase with low volume on the first day of its sudden breakout attempt without any catalyst is quite risky for my own take unless it is a delayed reaction from its disclosure on equipment acquisition.

|

| ECP_equipment_acquisition |

You may also check from PSE disclosures on the unusual price increase reply by ECP.

|

| ECP_unusual_price_movement_reply |

With ECP having an outstanding shares of 150M with only 11.14% free float (number of shares traded publicly) is easily manipulated by whales. Now ECP is trading almost one third (1/3) from its highest price of ₱76.50 as to this date of writing along ₱22.50

STOCK: HVN (Golden Haven Memorial Park Inc.)

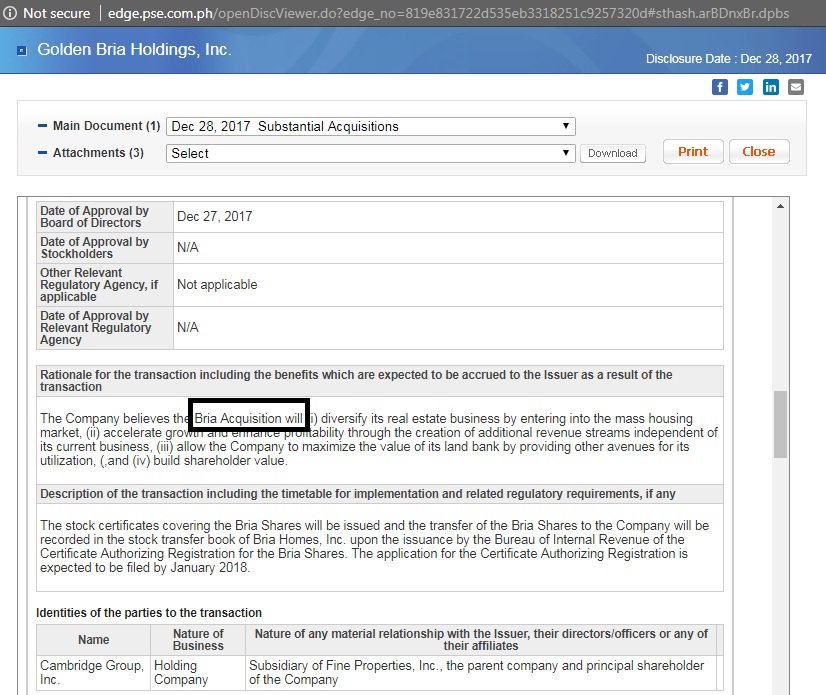

With HVN even with the low volume of trade (601.8k) reflected during its breakout somehow may be a delayed reaction also from its disclosure as early as December 28, 2017 from the Bria Homes acquisition that may triggered some traders or investors to buy this stock.

Though even if you have bought this below 200 price level with the current trading price as to this date of writing (₱307) still you are in a win win situation even with 1000 shares of purchase.

The timing is also perfect with a solid AOTS formation from its break out and was able to sustain its momentum with its follow through disclosures on its change of corporate name.

STOCK: HVN (Golden Haven Memorial Park Inc.)

With HVN even with the low volume of trade (601.8k) reflected during its breakout somehow may be a delayed reaction also from its disclosure as early as December 28, 2017 from the Bria Homes acquisition that may triggered some traders or investors to buy this stock.

Though even if you have bought this below 200 price level with the current trading price as to this date of writing (₱307) still you are in a win win situation even with 1000 shares of purchase.

The timing is also perfect with a solid AOTS formation from its break out and was able to sustain its momentum with its follow through disclosures on its change of corporate name.

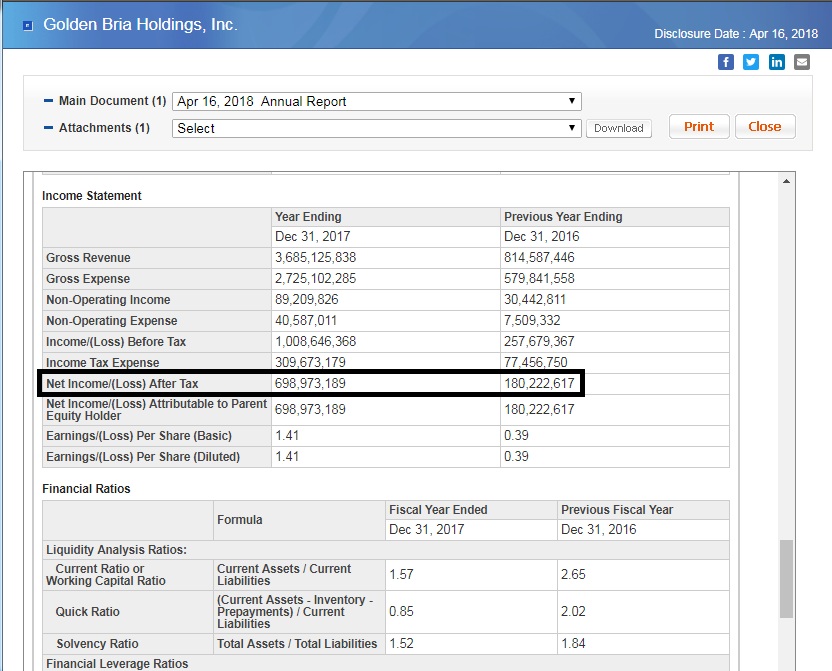

Followed by the increase of number of outstanding shares that somehow consolidated along 300 price level with a very positive net income of ₱698.9M from its previous year ending income of 180M from annual report.

|

| chart_from_investgarams_HVN_breakout |

|

| HVN_Bria_Acquisition |

|

| HVN_annual_report |

This is just my own point of view that since it has only an outstanding shares of 644M with only 10.59% free float which can also be easily manipulated since number of shares publicly traded is still low which may also be a factor on its rally.

Just remember that having low float can be easily hyped and manipulated which tends to be more volatile due to supply and demand, so if demand increases with less supply will drive the price higher.

Final say, it's up to you how you view "hyped" stocks as an opportunity to make money in the end, your own choice if you want to take the risks.

Just remember that having low float can be easily hyped and manipulated which tends to be more volatile due to supply and demand, so if demand increases with less supply will drive the price higher.

Final say, it's up to you how you view "hyped" stocks as an opportunity to make money in the end, your own choice if you want to take the risks.

If you find this helpful, say thanks by sharing this site to others!

0 Comments