One way to earn from the market is through dividends and will vary for every company if they decide to give you "cash" or "stock" dividends.

Do note that there are two types of shares with dividends, "common shares" this is what most of us trade in the market, the second are called "preferred shares*" giving fixed regular income but are not actively traded which would be a hard time to buy or sell.

*make sure to check from disclosure if it is for common or preferred shares and avoid the hype from other traders.

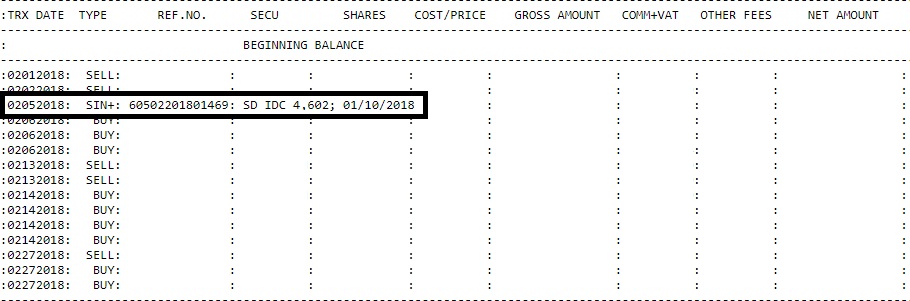

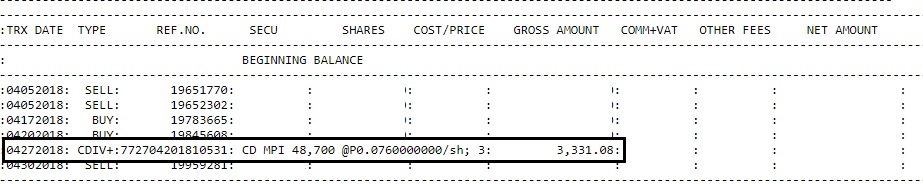

Sample Dividends

|

| cash_dividend_from_MBT |

|

| stock_dividend_from_IDC |

There is only one rule to be able to participate when such disclosures are made to the public and that would be holding your shares before an ex-date.

Granting that you don't have any shares yet and decided to participate, then you only need to get some shares before the ex-date and sell it the following day, no need to wait for the payment date.

Buying shares on the ex-date itself are not eligible to receive any dividends, instead the seller will get the rights to the dividends.

Before you jump in to dividend plays, be sure to do your homework to make the necessary computations on how much you will get in return.

From my own experience, to jump on the bandwagon on dividends with the belief that you will have additional shares or receiving cash without full understanding may differ to your expectations.

Try to search previous stocks that gave dividends and observe what happened before the ex-date, some have accumulated ahead while others sell a day before.

Observe what happens one day before the ex-date who comes out as winners, the sellers or the buyers?

If you read in advance on disclosure of dividends, check out if traders start to accumulate and you may start to be in position before the sell off before ex-date and during the ex-date itself.

notes to remember:

➥Cash dividends are subject to 10% withholding tax while non resident (aliens) in the country will have 25% tax deduction or higher.

➥Stock dividends on the other hand will be subject to price adjustments (dilute) similar to the concept of a Stock split.

Disclaimer: Sample charts provided are for educational purposes only.

SAMPLE STOCKS

STOCK: JFC

➤notice on previous candles that more were selling than buying, and two days before the ex-date some have bought shares.

➤before the ex-date sellers are more dominant turning it red, though with a small amount of volume present.

➤on ex-date itself selling pressure continues, so you will hear from traders saying sell on news which simply means they are not buying the news about dividends.

|

| chart_from_investagrams |

STOCK: MPI

➤on its first ex-date, as you can observe more were buying ahead of time and continued one day before the ex-date before some sold their shares on the ex-date itself ending in a doji candle.

➤for the second ex-date, still same pattern some started to accumulate shares but before the ex-date some started selling turning it red even with buying pressure present with that long shadow underneath the candle.

➤selling continued on ex-date itself.

|

| chart_from_investagrams |

STOCK: TUGS

➤compared to previous two above, this stock dividend play is different from cash dividend and try to pay attention if written on the disclosure that it may dilute the price or not but from experience most are diluted on the ex-date.

➤before the news, some accumulated and continued on the ex-date and traded sideways before the price increased.

➤since it is giving out +50% more to every holders, each holders will be presented as 100% holding + 50% = 150% total.

➤₱3.05 was its closing price before the ex-date and since will go price adjustment on ex-date, market will start to have an opening price of ₱2.03 (from ₱3.05/1.50).

➤added stock shares will only be reflected on the payment date together with your new average, whatever current average you have before the payment will remain so expect of a losing port if the price dives depending on the market reaction.

|

| chart_from_investagrams |

STOCK: IDC

➤here's another company with a 45% stock dividend with a closing price before the ex-date of ₱10.80 so expected opening price on ex-date is ₱7.44 (from ₱10.80/1.45).

➤some accumulated and sold before the ex-date while surprisingly on the ex-date more buyers came in but succeeding days were dominated by sellers.

➤as you may have heard from other traders, IDC as "traydor stock" so be cautious about considering this on your port.

|

| chart_from_investagrams |

Make sure to always do some computations ahead before you do your buying spree on dividends as you will never know if others are also with the same page as you are hoping that price may increase on such disclosures.

Hope you keep these in mind and always plan ahead.

0 Comments