You may have read or heard about "peso cost average" as a strategy for long term approach but with my journey through stocks I see this as a disaster.

Never will they tell you that the more you add up to a losing stock the more you inflate your losses, the lesser your buying power to utilize for your next trade battle.

Instead, they convince you it's just a "paper loss" and pamper you with high hopes that price will soon recover but reality no one can tell when it will happen.

Good thing when I started I practiced to buy in tranches and never gone "all in" to reserve some funds. After 2 months I started to rely on tips without checking at charts that I negated or just lazy to learn at that time.

Surely it was a disaster too that it took me more than a year to exit from a losing stock and only gain minimal amount, worst if I continued to invest in this stock to date with a market price around ₱39 (as of this writing October 2020).

My 1st year in the market yet I couldn't grasp how "cut loss" is much more useful than doing a peso cost average, well honestly at first it is easier to accept a paper loss that you see in your port than having your funds sliced with a cut loss.

If that will be your mindset to keep your "paper loss" and wait for a reversal then I say that would be unwise decision.

Not because you do some peso cost average even if you are an investor will make you safe from the market, you are still vulnerable to price market dives.

Disclaimer: Sample charts provided are for educational purposes only.

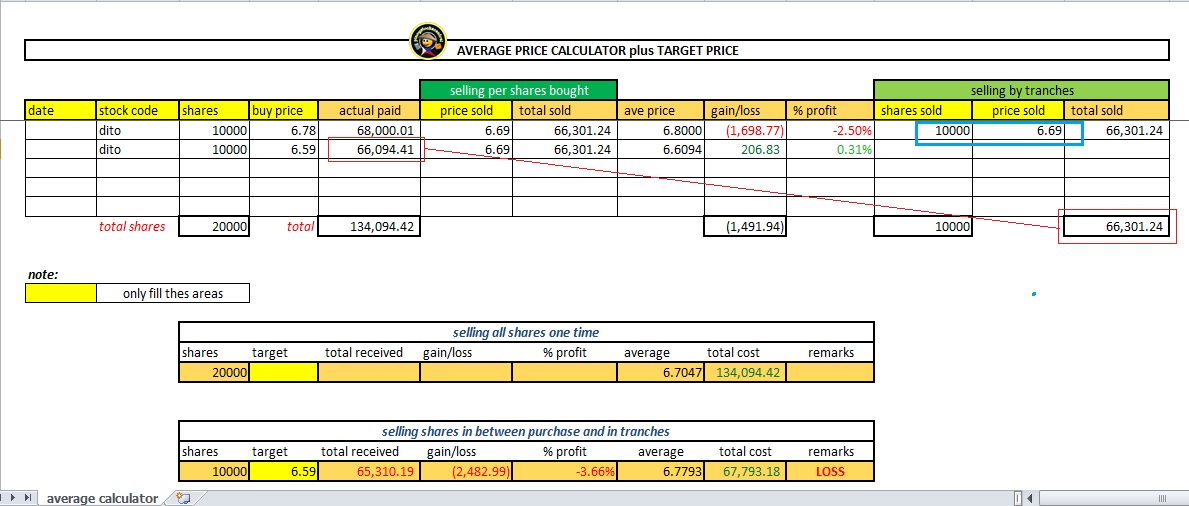

Let's take a look how you add more losses when you do some peso cost average.

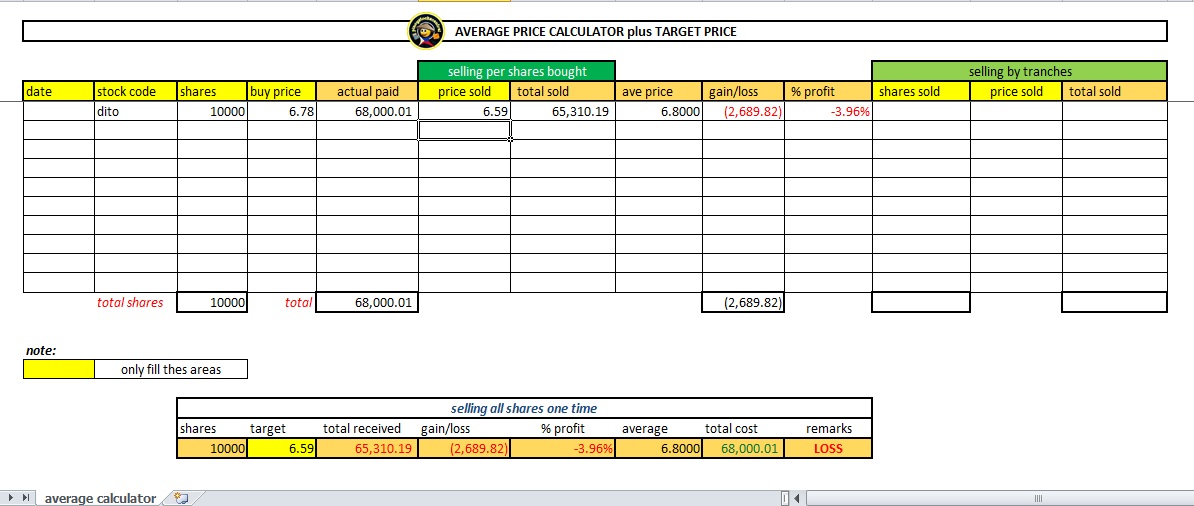

STOCK: DITO

Scenario 1:

You made a purchase of 10K shares then price went down

➤account size: ₱100,000.00

➤shares: 10,000

➤buy price: ₱6.78

➤average: ₱6.80/price

➤current market: ₱6.59

➤down: 3.96%

➤loss: ₱2,689.82

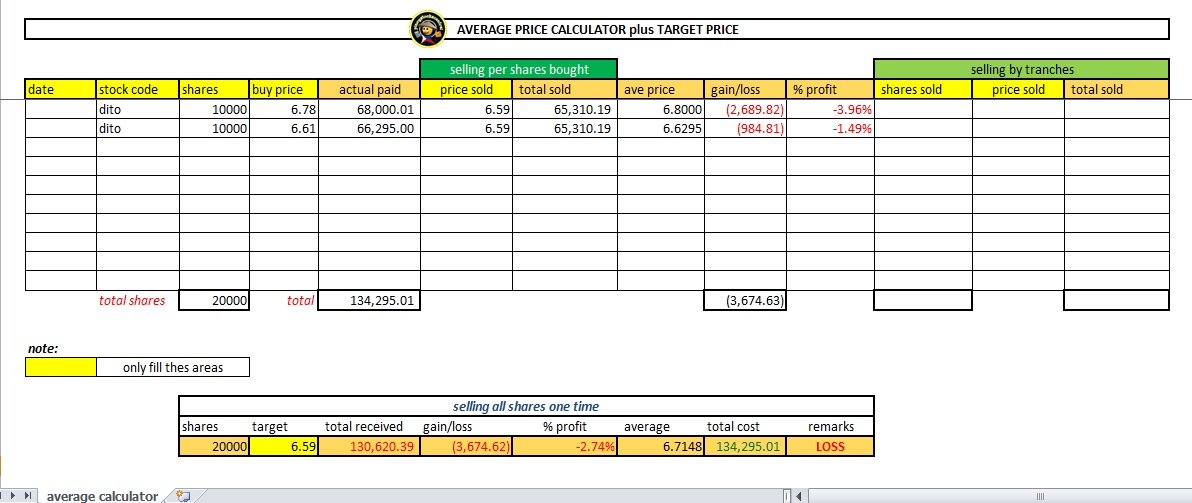

What if you add another 10,000 shares at ₱6.61 but still price went down?

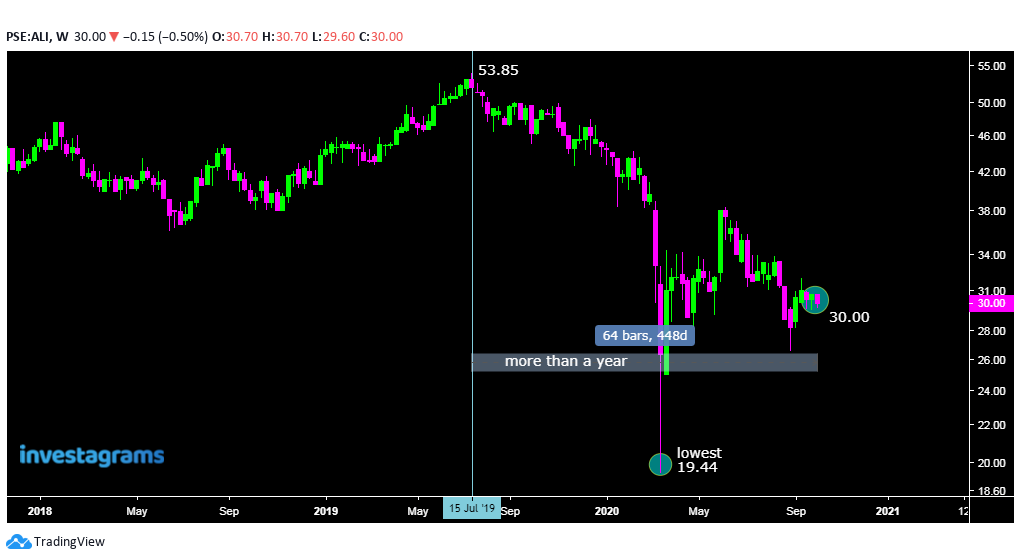

STOCK: ALI

Sample Average Down for ALI

result:

➤you need to top up your account with additional ₱34,295.01

➤buy price: ₱6.61

➤current market: ₱6.59

➤average: ₱6.715/price

➤down: 2.74%

➤loss: ₱3,674.62*

*notice how your loss increase!

Based from example above indeed your % of loss decreased from 3.96% to 2.74% which you may think you did the right thing but contrary you just increased your paper loss! The point that you lose some of your "buying power" you also added harm to your equity and the the need to top up your account.

Scenario 3:

What if you cut loss at ₱6.69 and wait for re entry?

➤sample how 10,000 shares computed with stop loss.

➤download var calculator here.

Compared from first two scenarios this will how we play the market

➤download var calculator here.

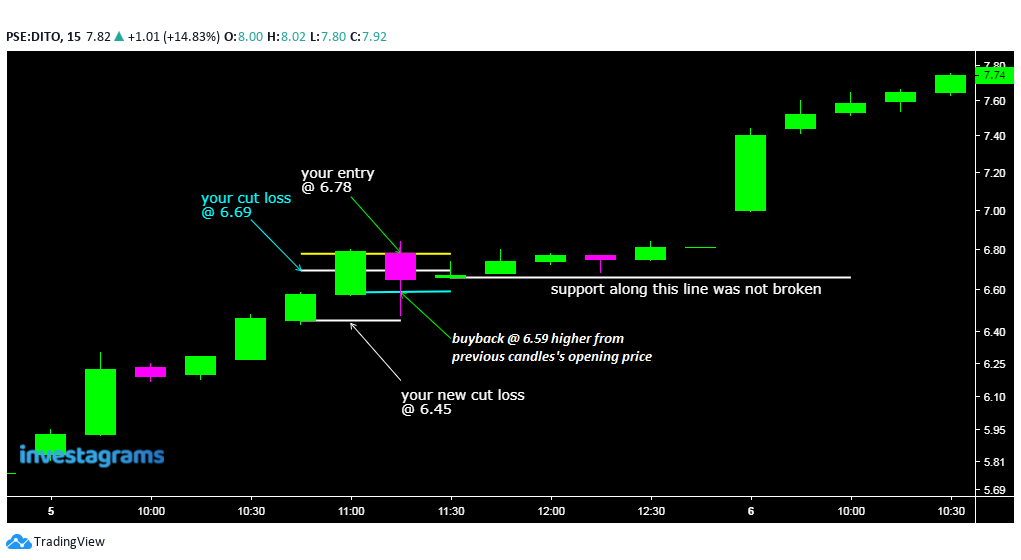

sample trade on a 15m tf

|

| chart_from_investagrams |

➤shares: 10,000

➤buy price: ₱6.78

➤average: ₱6.80/price

➤sold @ ₱6.69: ₱66,301.24 amount received*

➤loss: ₱1,698.77

➤re-entry: ₱6.59 (above opening price of previous candle)

➤buyback using amount received after cut loss

➤amount spent: ₱66,094.41 (you have excess of ₱206.83)

➤new average: ₱6.779/price*

➤current market: ₱6.59

➤down: 3.66%

➤loss: ₱2,482.99

note:

*the new average is just your reference that if you are able to sell above this price you will be able to redeem your previous loss from your cut loss (make sure to check the fees).

Lesson from sample trade

➤You minimized capital loss through cut loss and re-use to buyback at a certain entry without the need to top up your balance.

If things goes well and won't violate your 2nd stop loss level or entry then set an automated sell order via GTC (refer to post)

Failure to set up in advance will be tragic if you're not monitoring your port as anything can happen in the market, be watchful within the 1min sell offs.

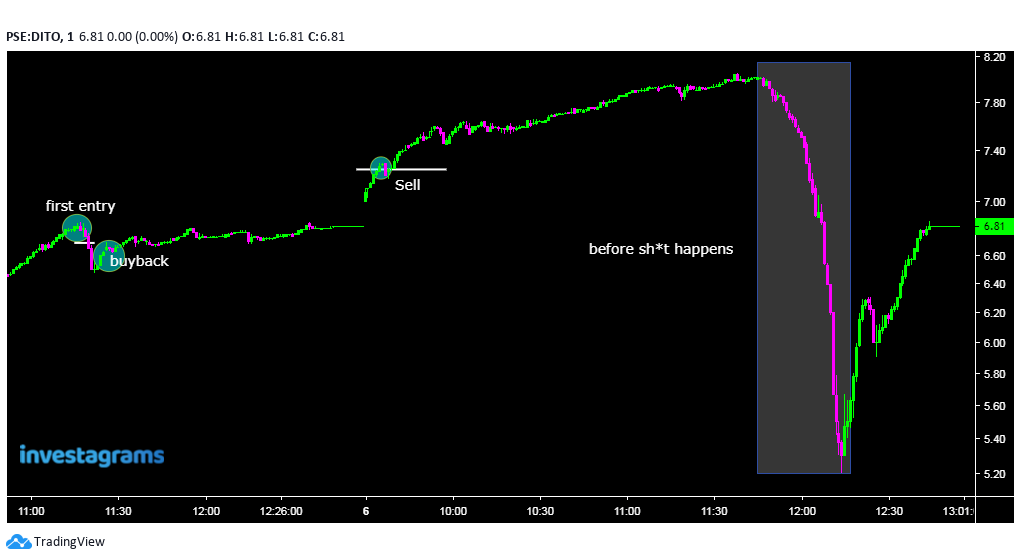

|

| chart_from_investagrams |

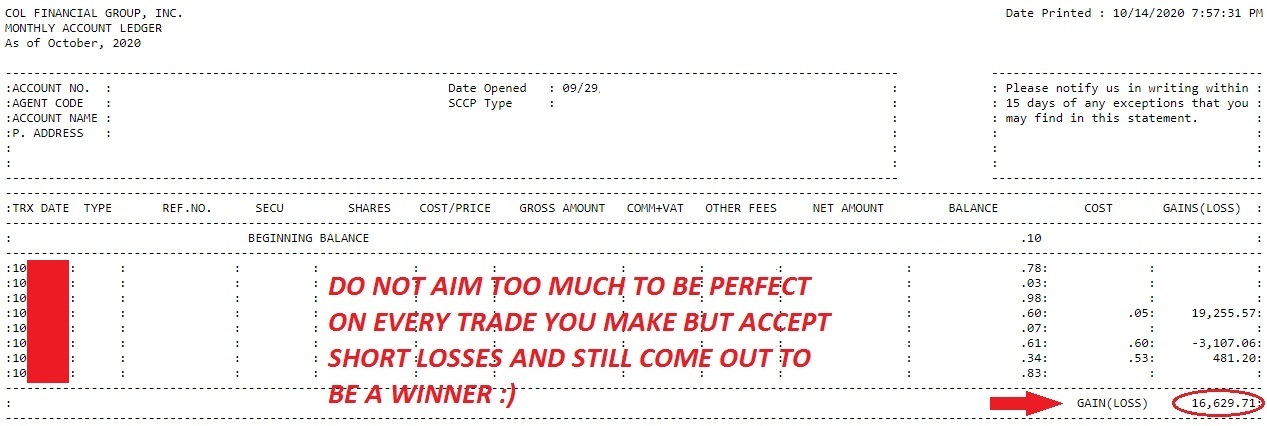

➤gain is gain, never regret if you didn't able to sell at the peak you can enter the market any time with a new fresh of "buy power" and be patient for another edge to appear and don't rush.

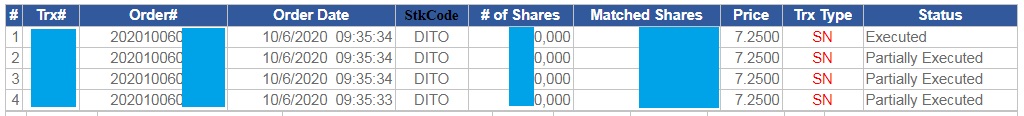

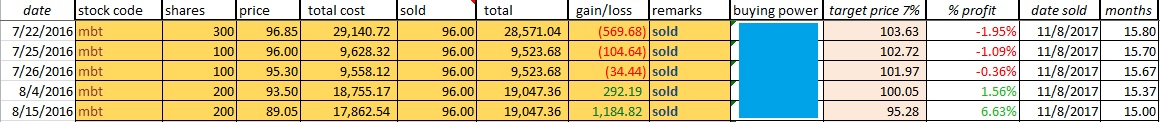

Sell history:

|

| dito_sell_trade_history |

My rules on Equity when I trade:

STOCK: AC

Rule No. 1: Protect your equity

Rule No. 2: Never forget rule no. 1

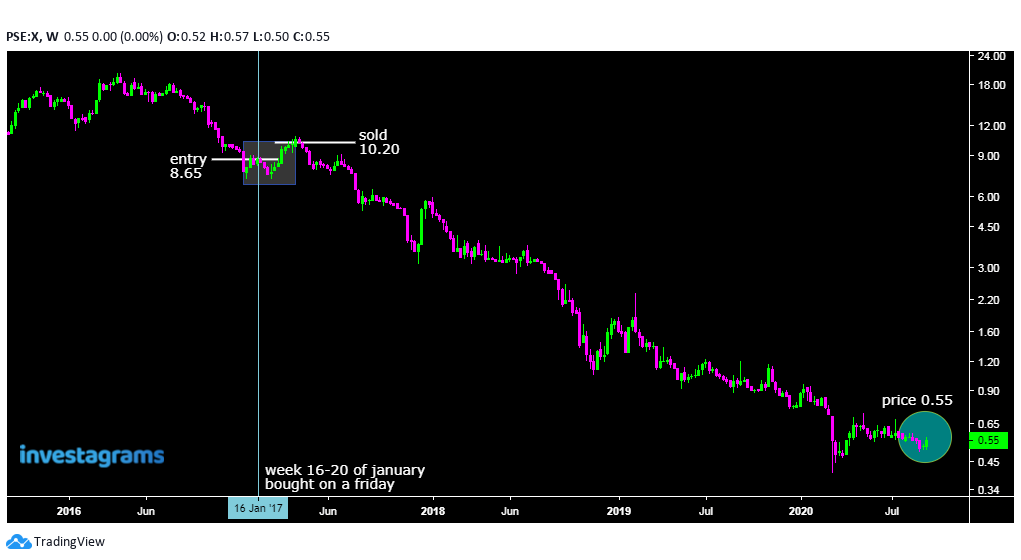

WHY AVERAGE DOWN IS A KILLER ON BEAR MARKETS

➤you'll never know when will price recover

➤you only add more losses that will stress you out

➤you run out of funds and miss out some buyback opportunities

➤you add more pressure where to get funds to top up your BP for the sake of lowering your AP

➤you'll have the bad habit to time the markets and trying to catch the bottoms

Facts:

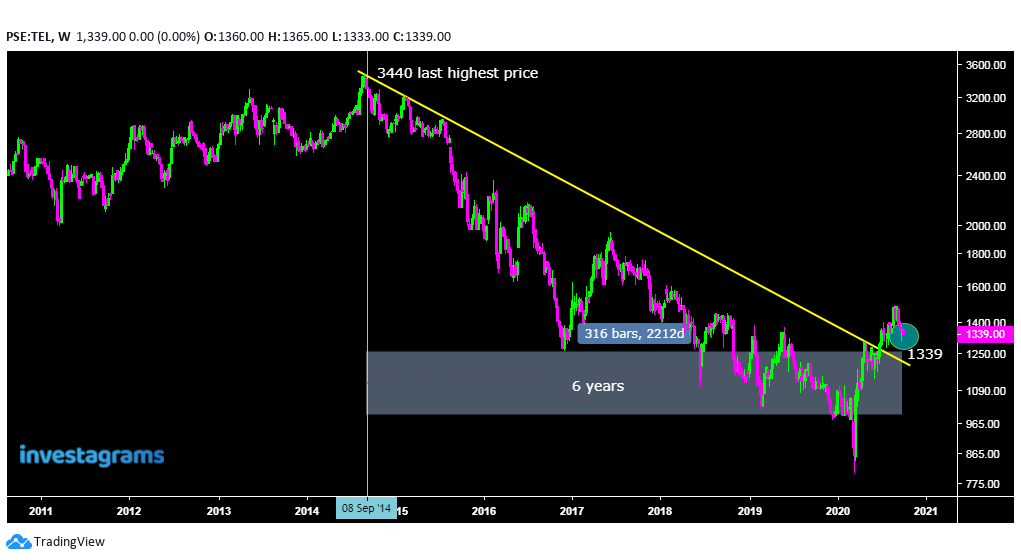

➤even big companies are not exempted

STOCK: TEL➤go check the charts yourself and tell if you will benefit more in a "peso cost average" on a diving market.

STOCK: X

|

| chart_from_investagrams |

STOCK: MPI

|

| chart_from_investagrams |

|

| chart_from_investagrams |

|

| chart_from_investagrams |

➤start of purchase from august 2019 to 2020 current market price of ₱30.00

➤even if you declare yourself to be an investor and diligently follow a monthly purchase to make some "peso cost average" will only lead to frustrations if the stock keeps going down.

➤average down is not a cure to a portfolio on a down market but will only get worse like rubbing salt into a wound.

result:

Portfolio down 24.31% loss

Final say, it's how you combine your edge with risk management and absorb short losses and patiently wait for a buyback, never add more losses to your paper.

Click to read another sample how I was able to make use of buying and selling in tranches using this calculator.

"Bato sa taas, salo sa ilalim"-pro traders mentality

0 Comments