This time out of boredom I have come up with another excel calculator that

I'll be sharing with a different approach. This is actually different from

how your brokers are computing your average every time you buy some shares

and you disposed some and added again number of shares and so on.

You may read here for sample broker's computation how it is done, take note that the last

average computed is carried over to the next if in case you sell some shares

and you decided to add some shares later on which will come up with another

average, it might be confusing at first but once you get the idea you will

easily understand how it is computed.

So the concept is quite simple you just take note of the total amount you paid

and deduct all amount received from all shares you sold and see if you were

able to make some profits.

For COL Financial, Philstocks and other brokers with the same computation of

fees is applicable to this excel file.

Disclaimer: Sample charts provided are for educational purposes only.

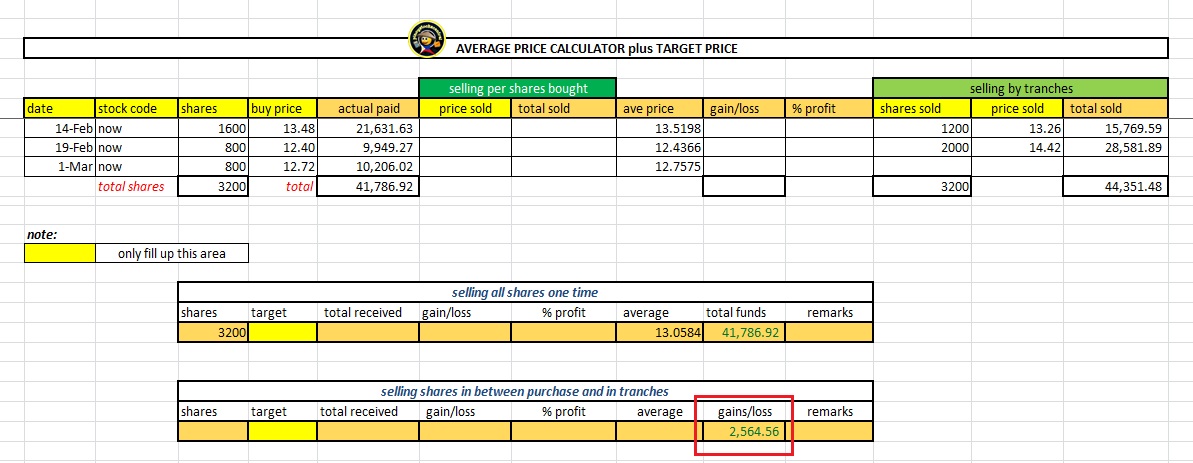

Let's see sample computation below:

STOCK: NOW

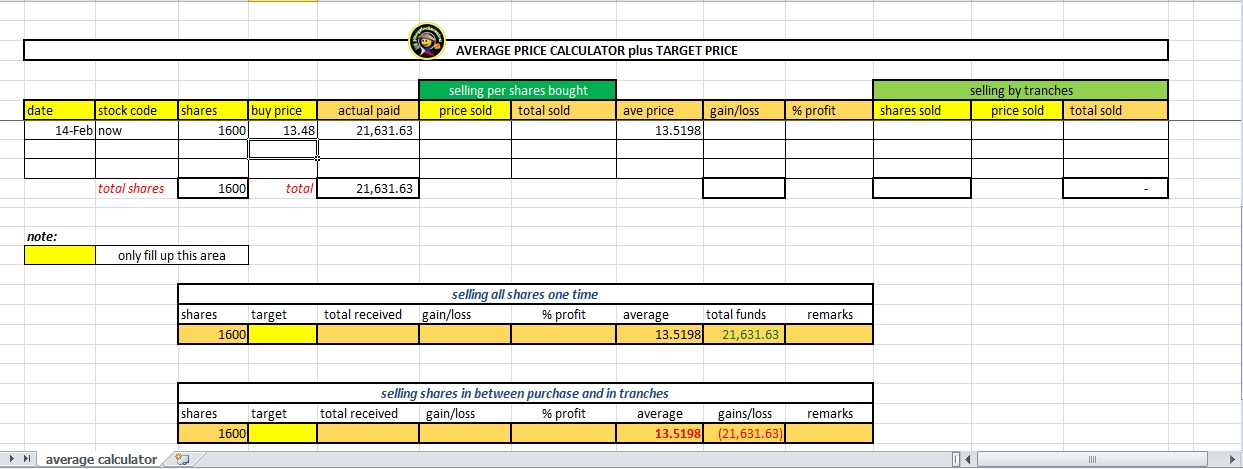

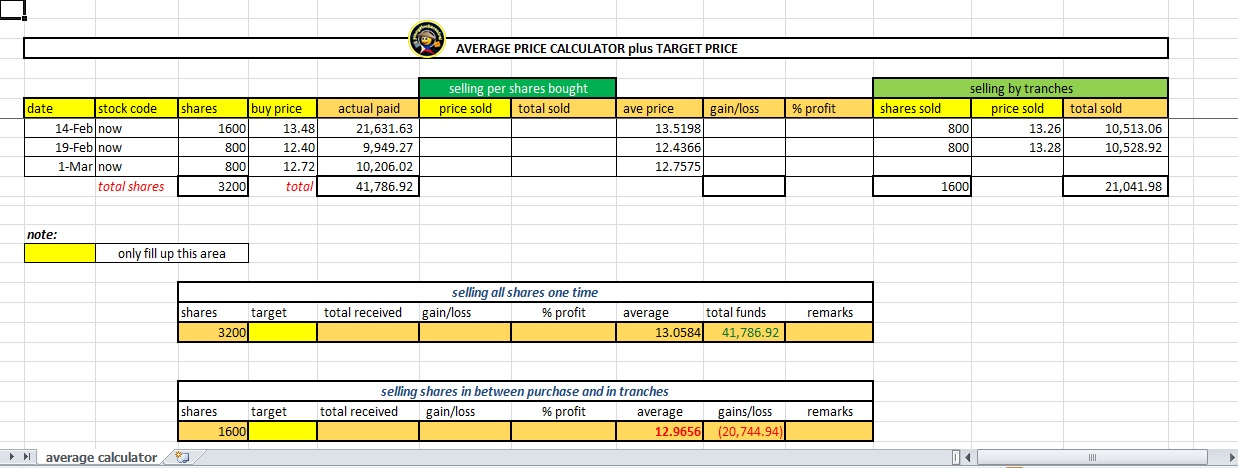

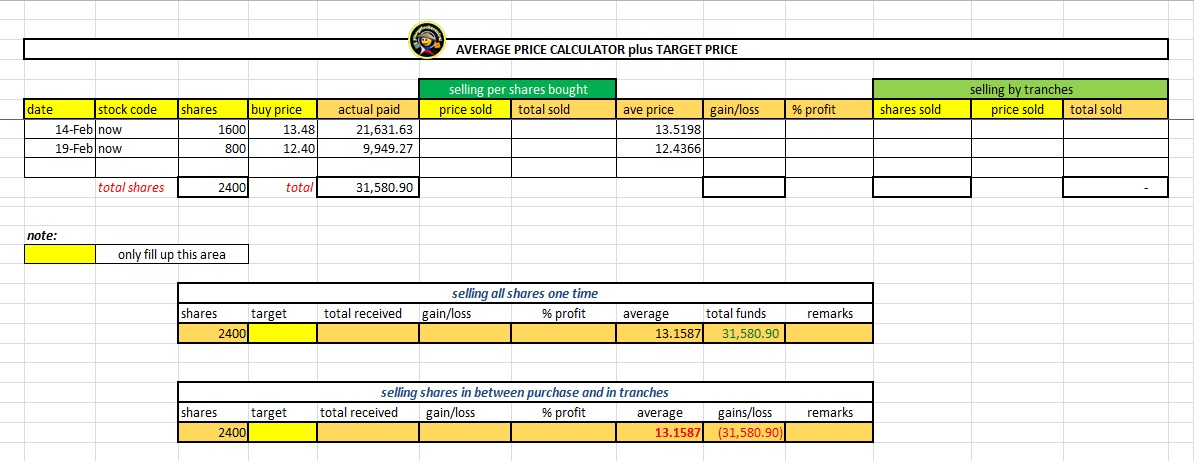

February 14, 2018 purchased 1,600 shares of NOW @ ₱13.48 with an

average of ₱13.5198

|

| 1st_purchase_NOW |

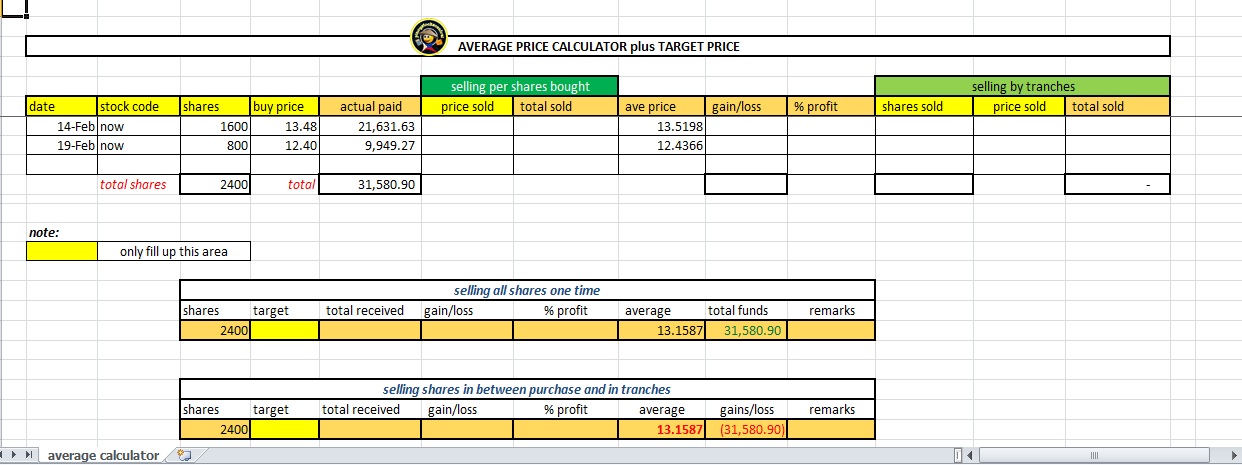

February 19, 2018 purchased 800 shares of NOW @ ₱12.40 with an

average now of ₱13.1587

|

| 2nd_purchase_NOW |

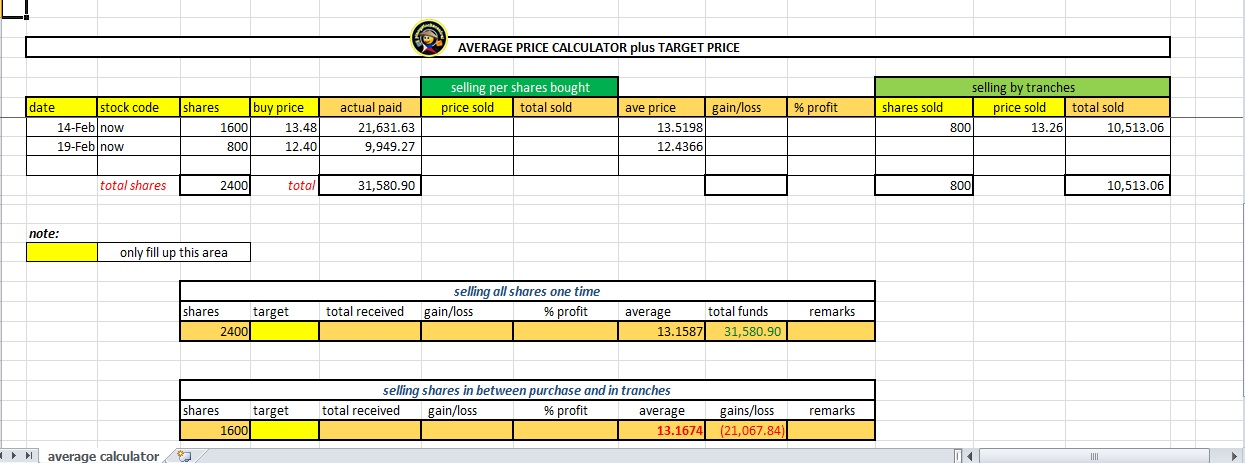

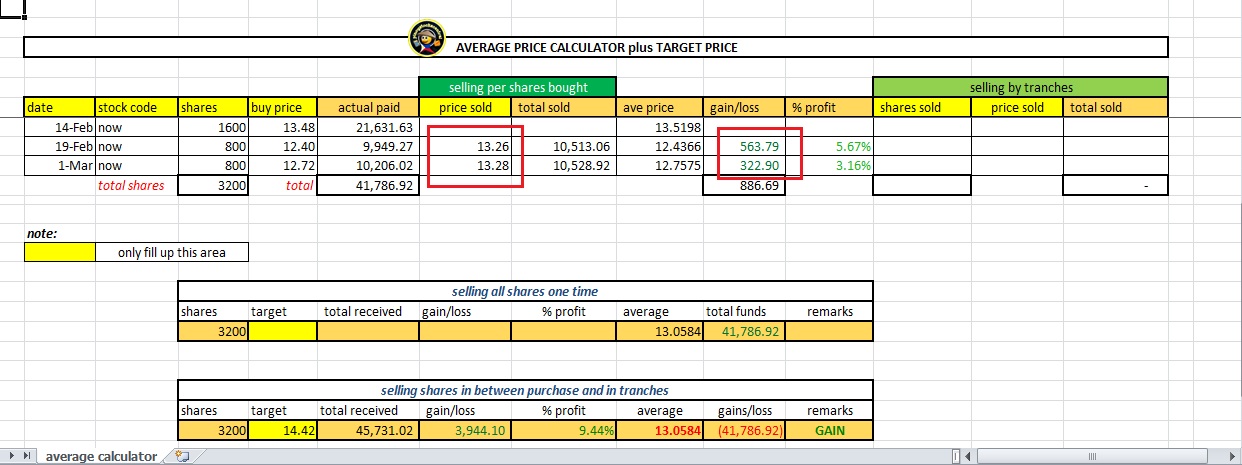

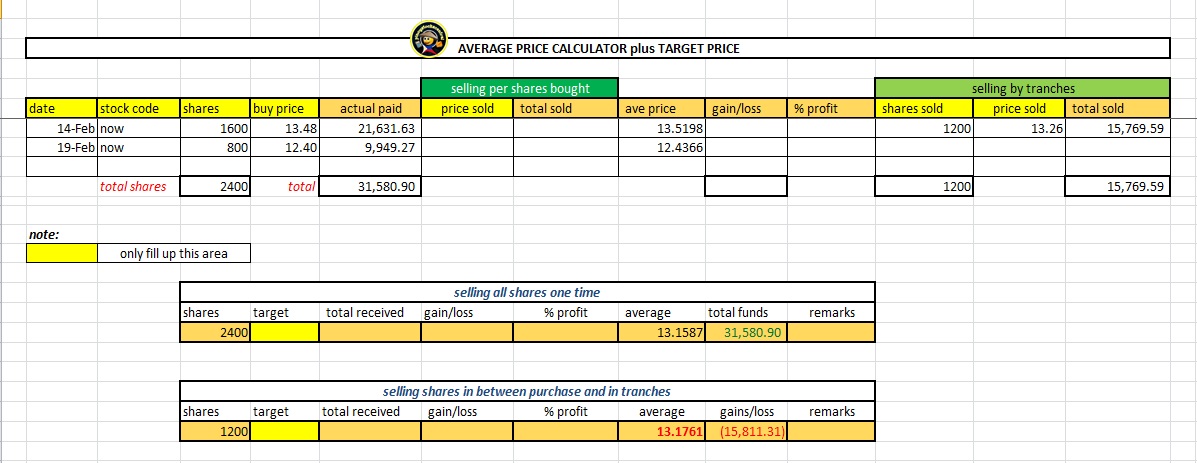

February 28, 2018 sold 800 shares of NOW @ ₱13.26 with still an

average now of ₱13.1587 if you are following your broker's method of computing

averages, whereas you will notice from below under "selling shares in between

purchase and in tranches" computed average is at ₱13.1674 with a negative gain

of ₱21,067.84 that I need to surpass when I sell my remaining 1,600 shares.

|

| 3rd_sold_portions_of_NOW |

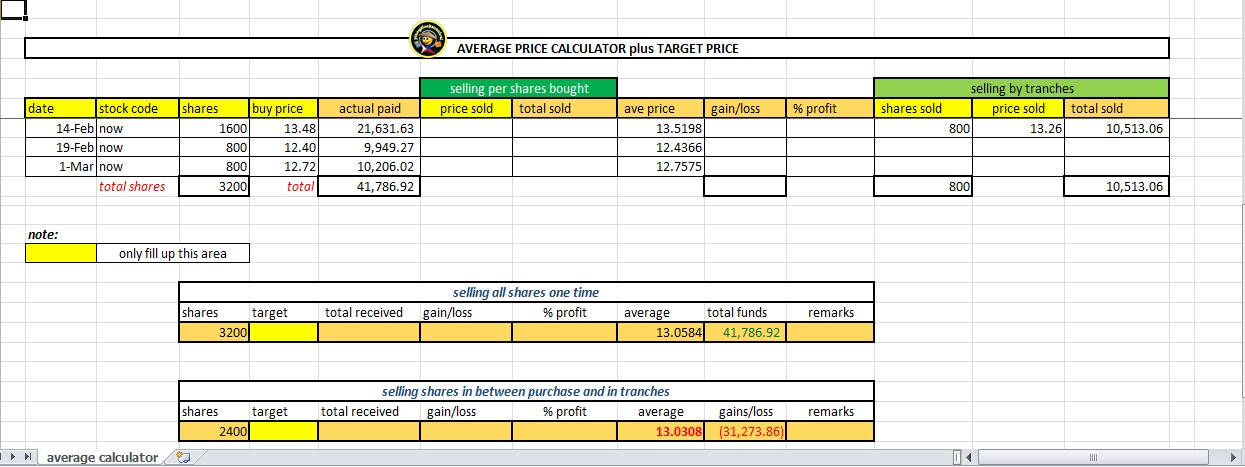

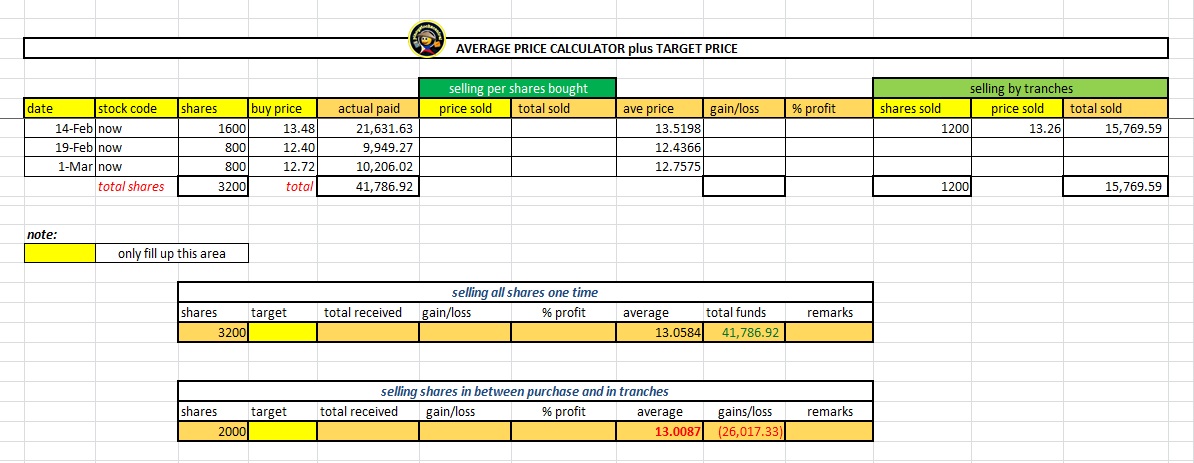

March 01, 2018 purchased 800 shares of NOW @ ₱12.72 with an average

now of ₱13.0308 (not from broker's computation which is at ₱13.0250) with a

negative gain of ₱31,273.86 that I need to surpass when I sell my remaining

2,400 shares.

|

| 4th_purchase_NOW |

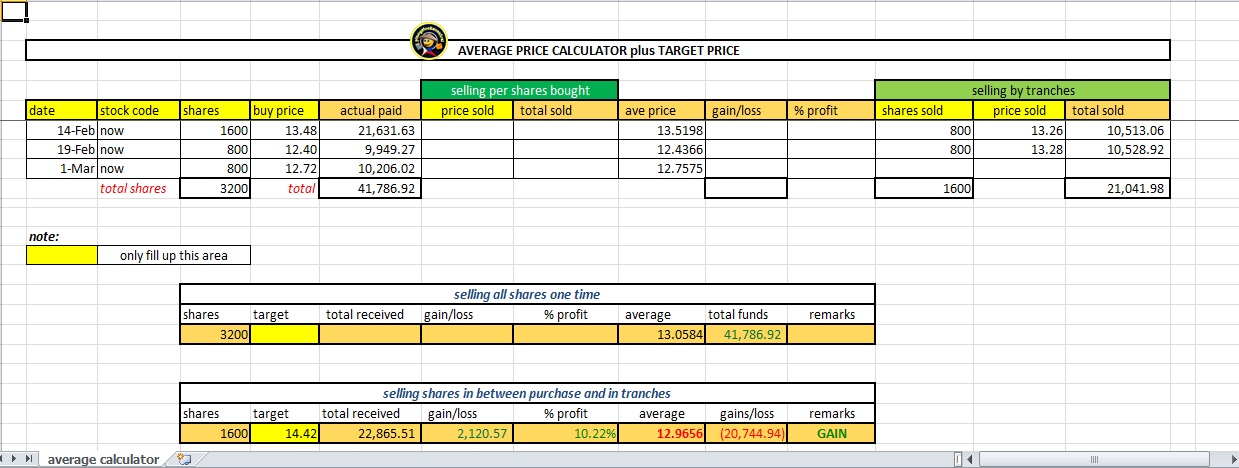

March 01, 2018 same day sold 800 shares of NOW @ ₱13.28 with an

average now of ₱12.9656 with a negative gain of ₱20,744.94 that I need to

surpass when I sell my remaining 1,600 shares.

|

| 5th_sold_portions_of_NOW |

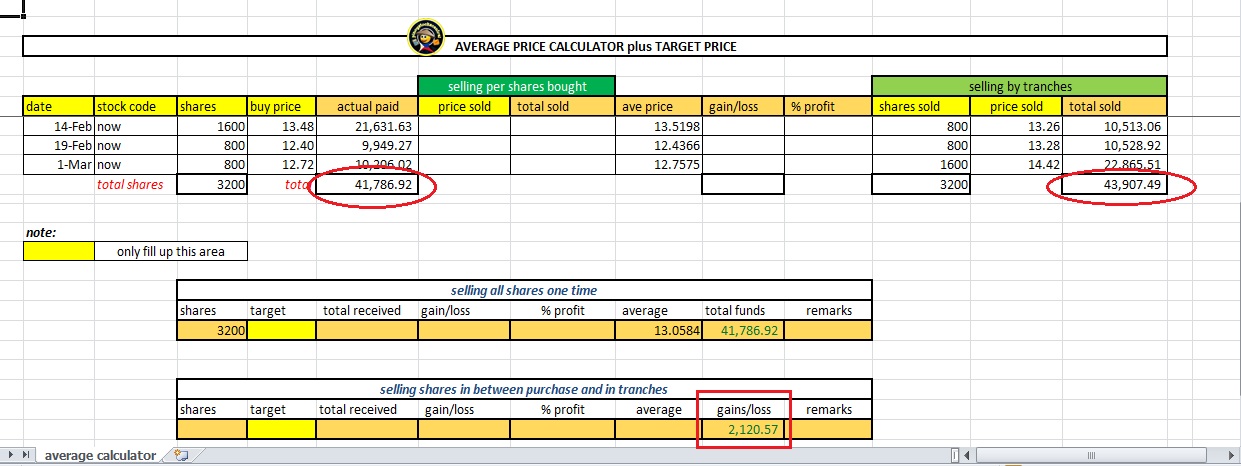

March 02, 2018 sold all 1,600 shares of NOW @ ₱14.42 with ₱2,120.57

profits, so the total amount received after selling remaining shares is higher

from my total payment of all shares.

|

| 6th_sold_all_position_of_NOW |

Trying to input from target price is also one way to check if you will make a

profit or not which is having an average of ₱12.9656 and same results

would come up with ₱2,120.57 profits.

|

| placing_target_price_to_surpass_your_current_average |

You may wonder how I know if I sold my previous shares of 13.26 and 13.28

respectively would give me gains is by filling up under "selling per shares

bought" column and not from "selling by tranches"

|

| counter_checking_if_sold_with_profits |

Here's a breakdown of the computation if done manually(fees included).

1,600 shares of NOW @ ₱13.48=₱21,631.63

800 shares of NOW @ ₱12.40=₱ 9,949.27

--------------------------------------------------------

2,400 shares ₱31,580.90 total amount paid

Sold

800 shares of NOW @ ₱13.26=₱10,513.06 amount received

Get the difference

₱31,580.90 - ₱10,513.06=₱21,067.84 remaining amount paid with 1,600 shares remaining

Bought another set of shares

800 shares of NOW @ ₱12.72=₱10,206.02 new amount paid

Add remaining amount paid and new amount paid

₱21,067.84 + ₱10,206.02=₱31,273.86 total amount paid with new 2,400 shares

Sold

800 shares of NOW @ ₱13.28=₱10,528.92 amount received

Get the difference

₱31,273.86 - ₱10,528.92=₱20,744.94 remaining amount paid with 1,600 shares remaining

Sold all remaining shares

1,600 shares of NOW @ ₱14.42=₱22,865.51 amount received

Sum up all amount received and deduct all total amount paid

₱10,513.06 + ₱10,528.92 + ₱22,865.51=₱43,907.49

less

₱31,580.90 + ₱10,206.02 =₱41,786.92

-----------------------------------------------------------------

₱ 2,120.57 profit

or simply get the difference of the last amount received with the remaining amount paid left recently

₱22,865.51 - ₱20,744.94=₱2,120.57

Not bad with less than a month with a total amount of ₱41,786.92 gained ₱2,120.57 compared to a time deposit of ₱50K that only yield ₱200+ interest in a year less tax that I experienced before from my local bank.

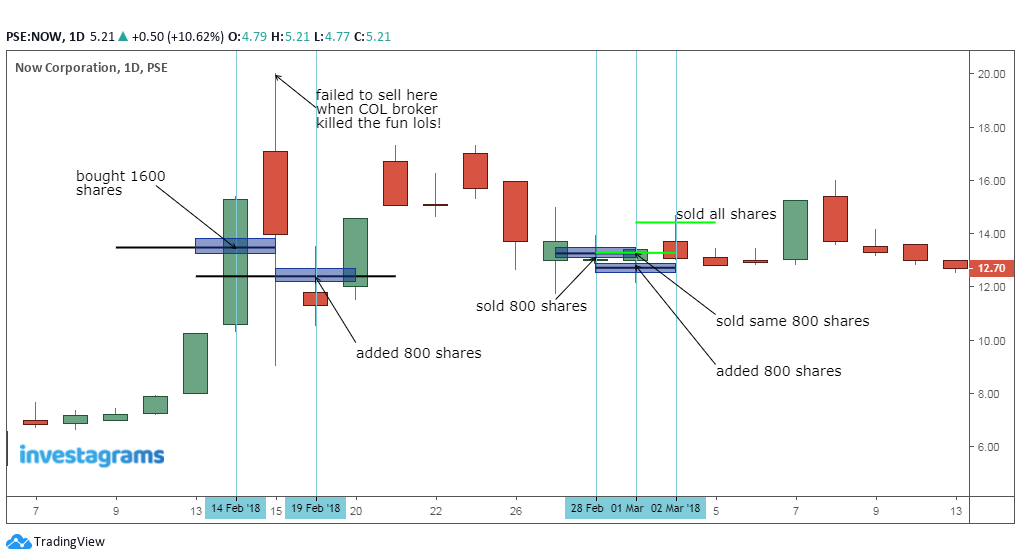

Looking at Charts

1,600 shares of NOW @ ₱13.48=₱21,631.63

800 shares of NOW @ ₱12.40=₱ 9,949.27

--------------------------------------------------------

2,400 shares ₱31,580.90 total amount paid

Sold

800 shares of NOW @ ₱13.26=₱10,513.06 amount received

Get the difference

₱31,580.90 - ₱10,513.06=₱21,067.84 remaining amount paid with 1,600 shares remaining

Bought another set of shares

800 shares of NOW @ ₱12.72=₱10,206.02 new amount paid

Add remaining amount paid and new amount paid

₱21,067.84 + ₱10,206.02=₱31,273.86 total amount paid with new 2,400 shares

Sold

800 shares of NOW @ ₱13.28=₱10,528.92 amount received

Get the difference

₱31,273.86 - ₱10,528.92=₱20,744.94 remaining amount paid with 1,600 shares remaining

Sold all remaining shares

1,600 shares of NOW @ ₱14.42=₱22,865.51 amount received

Sum up all amount received and deduct all total amount paid

₱10,513.06 + ₱10,528.92 + ₱22,865.51=₱43,907.49

less

₱31,580.90 + ₱10,206.02 =₱41,786.92

-----------------------------------------------------------------

₱ 2,120.57 profit

or simply get the difference of the last amount received with the remaining amount paid left recently

₱22,865.51 - ₱20,744.94=₱2,120.57

Not bad with less than a month with a total amount of ₱41,786.92 gained ₱2,120.57 compared to a time deposit of ₱50K that only yield ₱200+ interest in a year less tax that I experienced before from my local bank.

Looking at Charts

➤failure to sell the following day because of best friend COL broker had some

fun hanging around.

➤after additional shares again failed to sell when around 17sh due to

greed, rofl.

|

|

chart_from_investagrams |

Let's make another scenario same stock but modifying the number of shares

sold.

Say we purchased again the same number of shares of 1,600 and 800 with price of ₱13.48 and ₱12.40 respectively.

Say we purchased again the same number of shares of 1,600 and 800 with price of ₱13.48 and ₱12.40 respectively.

|

| purchased_shares_NOW |

Then we decided to sell half of our position of 1,200 shares @ ₱13.26

leaving us an average of 13.1761 or negative gain @ ₱15,811.31

|

| sold_half_shares_NOW |

Added again later on with 800 shares @ ₱12.72 with average of 13.0087

|

| purchased_new_shares_NOW |

Now selling all your positions of 2,000 shares @ ₱14.42 would give you

₱2,564.56

|

| sold_all_positions_NOW |

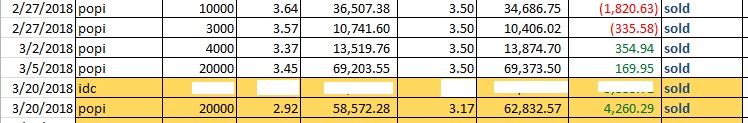

Let's make another sample case study on POPI (fees included)

10,000 shares of POPI @ ₱3.64=₱ 36,507.38 2/27/2018

3,000 shares of POPI @ ₱3.57=₱ 10,741.60 2/27/2018

4,000 shares of POPI @ ₱3.57=₱ 13,519.76 3/02/2018

20,000 shares of POPI @ ₱3.45=₱ 69,203.55 3/05/2018

20,000 shares of POPI @ ₱2.92=₱ 58,572.28 3/20/2018

57,000 shares ₱188,544.57 total amount paid

Just to give you again an idea how your broker computes for your average is simply dividing the total amount paid with the total number of shares:

₱188,544.57/57,000 shares = ₱3.3078 per share

Now say we disposed 20,000 shares at a price of ₱3.17 = ₱62,832.57 (amount you will receive) but the current average reflected from your online account would still be at ₱3.3078 per share.

To shun away from your typical broker average computation simply get the difference from the total amount you paid with the amount you received and divide with the remaining shares to get your current average.

total paid less amount received

₱188,544.57 - ₱62,832.57 = ₱125,712.00 (amount left invested)

amount left divided by remaining shares to get average

₱125,712.00/37,000 shares remaining = ₱3.3976 per share

April 16, 2018 the price of POPI went up as high as ₱3.56 per share then dropped around ₱3.50 per share and your broker will show you a profit of ₱5,952.38 from a traded market price of ₱3.50 with an average of ₱3.3078 per share.

10,000 shares of POPI @ ₱3.64=₱ 36,507.38 2/27/2018

3,000 shares of POPI @ ₱3.57=₱ 10,741.60 2/27/2018

4,000 shares of POPI @ ₱3.57=₱ 13,519.76 3/02/2018

20,000 shares of POPI @ ₱3.45=₱ 69,203.55 3/05/2018

20,000 shares of POPI @ ₱2.92=₱ 58,572.28 3/20/2018

57,000 shares ₱188,544.57 total amount paid

Just to give you again an idea how your broker computes for your average is simply dividing the total amount paid with the total number of shares:

₱188,544.57/57,000 shares = ₱3.3078 per share

Now say we disposed 20,000 shares at a price of ₱3.17 = ₱62,832.57 (amount you will receive) but the current average reflected from your online account would still be at ₱3.3078 per share.

To shun away from your typical broker average computation simply get the difference from the total amount you paid with the amount you received and divide with the remaining shares to get your current average.

total paid less amount received

₱188,544.57 - ₱62,832.57 = ₱125,712.00 (amount left invested)

amount left divided by remaining shares to get average

₱125,712.00/37,000 shares remaining = ₱3.3976 per share

April 16, 2018 the price of POPI went up as high as ₱3.56 per share then dropped around ₱3.50 per share and your broker will show you a profit of ₱5,952.38 from a traded market price of ₱3.50 with an average of ₱3.3078 per share.

|

| POPI_portfolio_from_COL |

In reality when you sell those remaining 37,000 shares at ₱3.50 you will only

pocket around ₱2,628.97 not what your broker is showing you in your

port.

To justify this remember you paid a total amount of ₱188,544.57 then you deduct the amount you receive after selling 20k shares amounting to ₱62,832.57 which would leave you as mentioned above an amount of ₱125,712.00

If you sell remaining 37k shares at ₱3.50 you will receive an amount of ₱128,340.97 and try to deduct the amount left of ₱125,712.00 and you get a net amount of profit of ₱2,628.97 or adding up all the negative and positive gains will still give you the same result as shown below monitoring sheet.

₱-1,820.63 + ₱-335.58 + ₱354.94 + ₱169.95 + ₱4,260.29 = ₱2,628.97 (same as above)

To justify this remember you paid a total amount of ₱188,544.57 then you deduct the amount you receive after selling 20k shares amounting to ₱62,832.57 which would leave you as mentioned above an amount of ₱125,712.00

If you sell remaining 37k shares at ₱3.50 you will receive an amount of ₱128,340.97 and try to deduct the amount left of ₱125,712.00 and you get a net amount of profit of ₱2,628.97 or adding up all the negative and positive gains will still give you the same result as shown below monitoring sheet.

₱-1,820.63 + ₱-335.58 + ₱354.94 + ₱169.95 + ₱4,260.29 = ₱2,628.97 (same as above)

|

| POPI_monitoring_sheet |

How your broker try to compute for your average you might wonder how they come

up with the ₱5,952.38 profit shown in your port so let's make a quick

computation how they derived that amount.

37k shares x ₱3.3078 per share = ₱122,388.60 (using your broker's computed average at ₱3.3078)

37k shares x ₱3.50 per share = ₱128,340.97 (amount received)

₱128,340.97 less ₱122,388.60 = ₱5,952.37 profit shown from port (decimal discrepancy on rounding off numbers)

Now go ahead and play around with your average and come up with a strategy on how you can make a profit minimizing some cut loss in selling all your shares one time but rather trying to dispose in tranches and try to re-balance your port then decide if you are happy with the gains.

Again your main concern here is not the total amount you will be able to pocket but trying to lessen some risks and would still come up with a gain in the end which will help you out to perfect your system for your winning trades.

It doesn't matter if you lose twice but win three times that would still cover up your loses as sample above would still a good way to be rewarded from the market.

Do this with consistency and your money will grow in time, just make sure the amount received that returned in the end would be greater from your total invested amount, simple math and you can do it yourself as most are focused on the gains and not on the strategy that's why they lose more money.

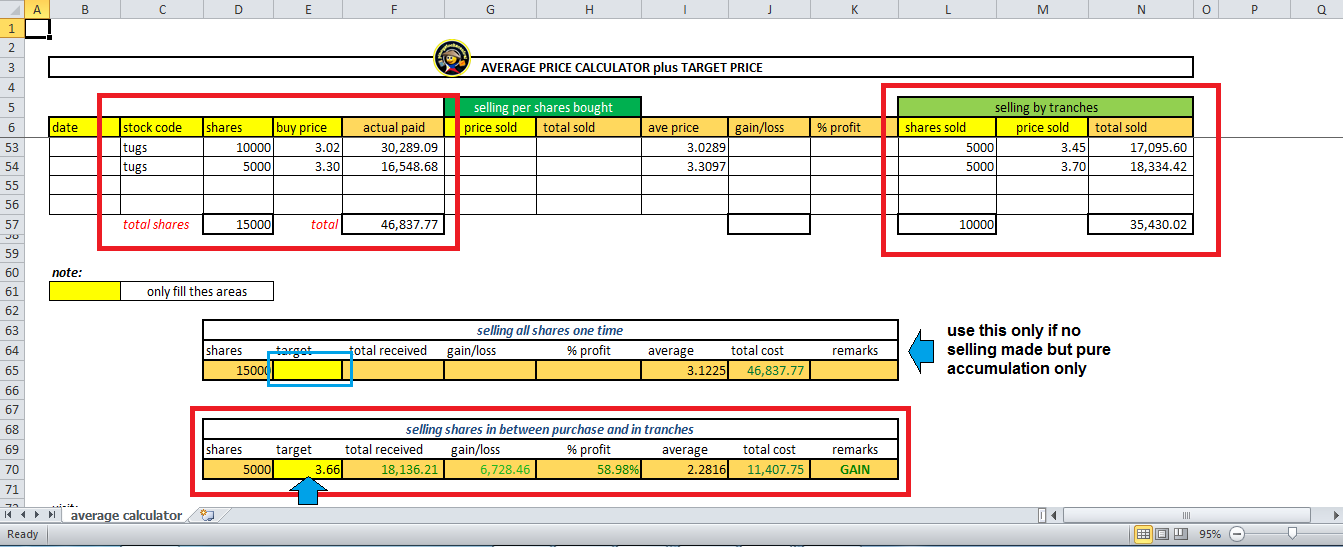

Just an update I made some changes instead of gain/loss I renamed it to total cost instead, so you may know how much you paid for the remaining shares left and make sure when you sell it exceed this total cost amount reflected.

Basically when you input your target price it will tell you if you gain or at a loss anyway considering the current average price that you have.

Sample screenshot:

37k shares x ₱3.3078 per share = ₱122,388.60 (using your broker's computed average at ₱3.3078)

37k shares x ₱3.50 per share = ₱128,340.97 (amount received)

₱128,340.97 less ₱122,388.60 = ₱5,952.37 profit shown from port (decimal discrepancy on rounding off numbers)

Now go ahead and play around with your average and come up with a strategy on how you can make a profit minimizing some cut loss in selling all your shares one time but rather trying to dispose in tranches and try to re-balance your port then decide if you are happy with the gains.

Again your main concern here is not the total amount you will be able to pocket but trying to lessen some risks and would still come up with a gain in the end which will help you out to perfect your system for your winning trades.

It doesn't matter if you lose twice but win three times that would still cover up your loses as sample above would still a good way to be rewarded from the market.

Do this with consistency and your money will grow in time, just make sure the amount received that returned in the end would be greater from your total invested amount, simple math and you can do it yourself as most are focused on the gains and not on the strategy that's why they lose more money.

Just an update I made some changes instead of gain/loss I renamed it to total cost instead, so you may know how much you paid for the remaining shares left and make sure when you sell it exceed this total cost amount reflected.

Basically when you input your target price it will tell you if you gain or at a loss anyway considering the current average price that you have.

Sample screenshot:

|

| Average_price_calculator |

If you find this helpful, say thanks by sharing this site to others!

4 Comments

i cant find the excel on the link your provide.

ReplyDeleteSo how can i get the excel of Buying and Selling in Tranches Average Computation?

or can you send it to me at Jayden.tkl@gmail.com

Thanks alot

https://paybitly.pw/excel updated link cheers!

ReplyDeleteNot working sir.

DeleteSolve media, click to continue, wait for timer, scroll down and click get link

Deleteor go to https://onlinenepal.net/file/ZGVmY2

click on free download, generating download, download, proceed download,solve captcha, start download