The market will be the battleground between "impatient" and "patient" participants regardless if you're a trader or an investor.

Like the game of chess for most players who are impatient and rush to make movements without a plan will lose the game.

No different with stocks you need to have a plan and calculate every step you make and sacrifice some losses to get a better position with patience.

Failure to do so will trigger your emotions when you will be caught from "sell offs", I have gone through many times with these before and have changed my strategy on how to deal with these.

Disclaimer: Sample charts provided are for educational purposes only.

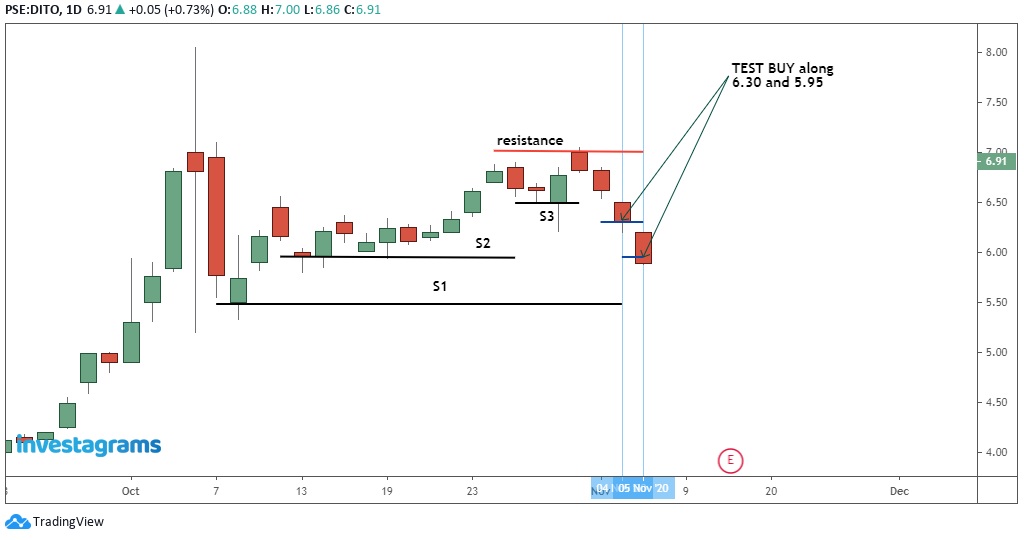

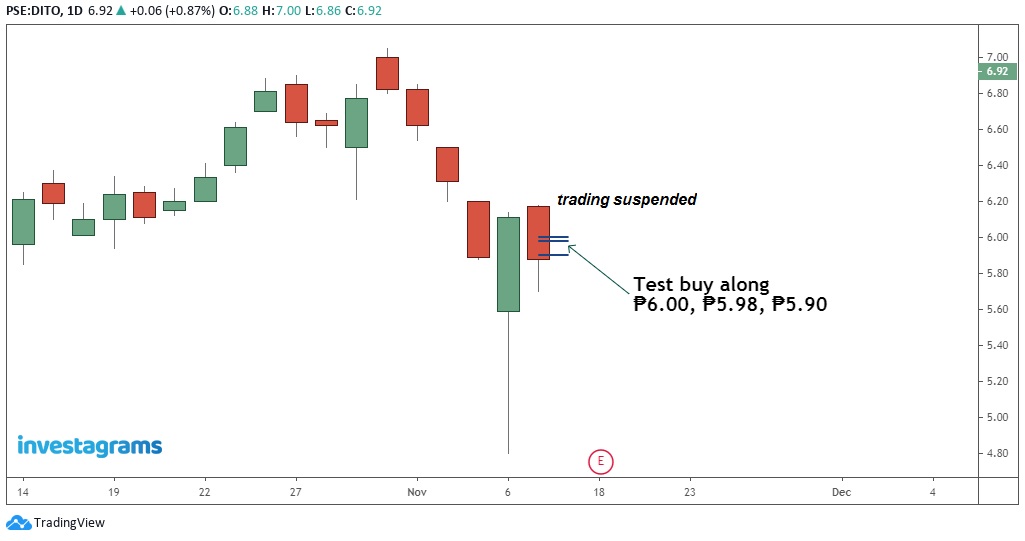

STOCK: DITO

➤Always make it a habit to accept the fact that anything can happen in the market, so don't get surprised if there will be gap up and gap downs on a particular stock as the price will depend on supply and demand.

➤Here I have seen three supports on a Daily tf which served as my reference and observed if S3 will be able to hold up but good thing I did not rush to make some entry rather waited for the 3rd candle.

➤On the 4th candle selling pressure is still there as it broke down also to S2 but added some more shares.

➤Well I still have S1 as my last line of defense that's why I hold up on my position.

|

| chart_from_investagrams_DITO |

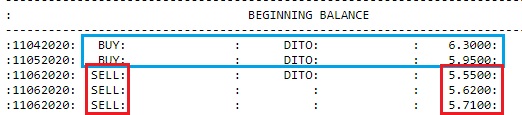

Now on the 5th candle opening price started with ₱5.59 (ouch!) there was a GAP Down of price! from previous closing price of ₱5.88 and went as low as ₱4.80

|

| chart_from_investagrams_DITO |

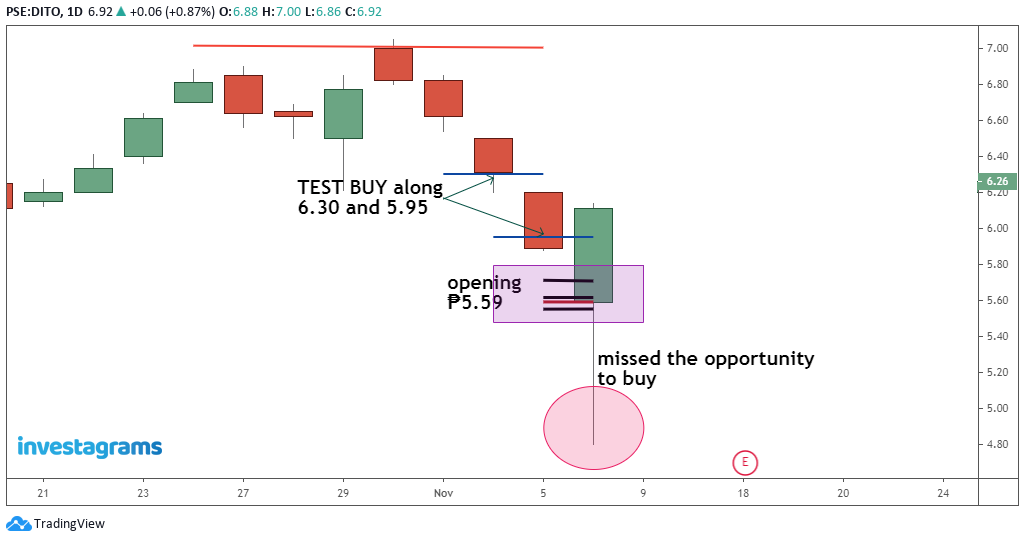

Good thing I was able to sell in tranches from ₱5.55, ₱5.62, ₱5.71

|

| trade_history_ledger_COL |

For obvious reason you can say immediately I sold at a loss, but somehow it would be more painful on my port if the sell off continued below ₱4.80 that's why I need to dispose as quick as I can.

|

| chart_from_investagrams_DITO |

After absorbing those losses, unfortunately the market started to bounce back from its lowest price that's why you can see from chart that it ended up with a green candle.

I managed to buy some number of shares and sold the last batch of shares from original purchase within that day to test the waters if there will still be sell offs to happen.

|

| trade_history_ledger_COL |

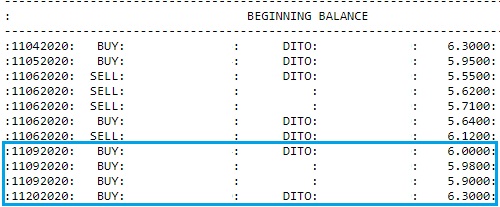

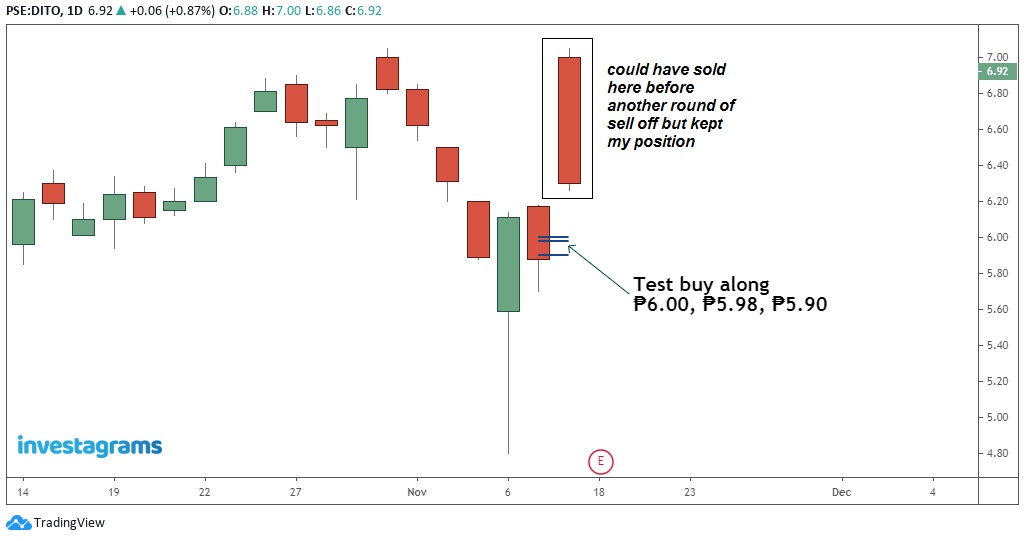

With DITO restructuring PSE have to suspend trading temporarily but I was able to get some chunks of shares and added more after it resumed instead of selling.

|

| trade_history_ledger_COL |

|

| chart_from_investagrams_DITO |

When trading resumed of course there was another pump and dump that took place but I just hold on to my position.

|

| chart_from_investagrams_DITO |

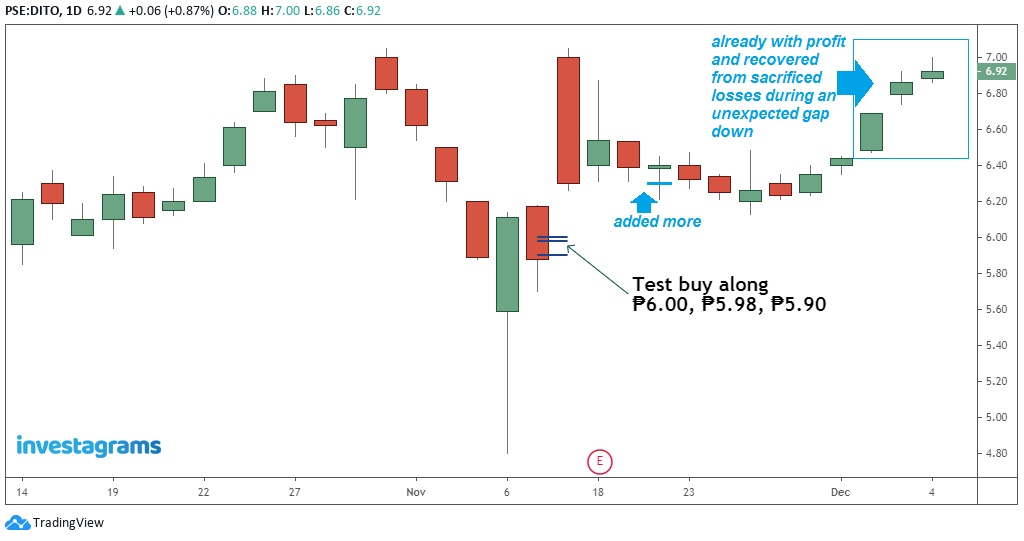

Let us check if indeed I was able to make profit if I sold when trading resumed along ₱6.92

Breakdown:

➤40,000 shares DITO

➤₱245,722.75 total amount paid

➤₱227,941.49 total amount received when sold in tranches

➤₱17,781.26 loss

Buyback (was not able to complete the 40k shares)

➤25,000 shares DITO repurchase in tranches

➤₱146,230.12 total amount paid for the buyback

➤₱81,711.37 excess amount after purchase

➤₱6.5065 new average (taken from ₱146,230.12 + ₱17,781.26 divided by 25k shares)

Profit

➤25,000 shares DITO to be sold

➤₱6.92 selling price per share

➤₱171,451.65 total amount received when sold

➤₱253,163.02 total amount of cash at hand (from ₱171,451.65 + ₱81,711.37 )

➤₱7,440.27 (from ₱253,163.02 - ₱245,722.75) profit

Now if only I know that it will bounce and will just hold on to my original shares of 40K then perhaps I could have collected bigger profit.

The thing is we could never know so better be safe than adding more losses but still even if I was not able to repurchase back the same volume as original somehow it would still give me profits.

Since I added more shares the market gave me opportunities to exit with a clean profit.

This is how you practice to get rid of your emotions when you trade don't be afraid of those small loses as you can still recover as the market will always gives you number of chances.

Your indicators are just like your chessboard with your current position against your opponent as it pictures out if you are in danger or in a winning position.

The most crucial part would be on how you manage to move your pieces with the proper combination either sacrificing a pawn, a Knight, Bishop or even the Queen etc just to escape a checkmate threat or to get an advantage.

That would now put your money management skills to the test when you are in the market as losing some is part of your winning the game.

Check also my other post on buying and selling in tranches and get the idea on how you will try to play around with your stocks as do the basic math calculations if you will profit or not in the end and not focus too much on a perfect trade but managing your money wisely. ("Sana Ol")

In case you want to learn more trading secrets feel free to visit and click the link below.

If you find this helpful, share with friends!

0 Comments