These are just my thoughts based on what I observed as well as some of my own experience and if you happen to have these mindset, it's not too late to reflect and try to reboot or be a slave of your own ego.

The Lazy trader

New retail traders who comes in the market suffer losses because they rely on tips/reco instead of learning it themselves.

If the tipster says "buy this stock it's a good buy!" (baka naman goodbye!), while if they say sell your stock now! (baka naka Sale! kaya bibili sila)

"A man must believe in himself and his judgement if he expects to make a living at this game. That is why I don’t believe in tips."-Jesse Livermore

This becomes a bad habit as unconsciously they program their minds that if a tip they acquired fails, they resort to "hope and pray" strategy.

However, if by luck those tips turns out promising, one will get too obsessed on the profits and keeps relying on tips even more.

Another scenario if turned out to be a winning stock suddenly with a blink of an eye here comes the big drop and instead of a profit it turned into loss. "Nang hype sabay buhos"

Fear of losing money

The problem now will soon arise the moment they suffer their first loss of the trade then get emotional and in turn will clench to "hope and pray" habit as well.

Worst scenario, they start to average down as means to comfort themselves that they turned themselves into investors when the market goes the other direction.

Fact: The Market will always be right!

Adding more losses to your paper will add more pressure to come up with more funds for the sake of lowering down your average, stressful right?

Never listen to tips, instead check what the market is telling you.

Disclaimer: Sample charts provided are for educational purposes only.

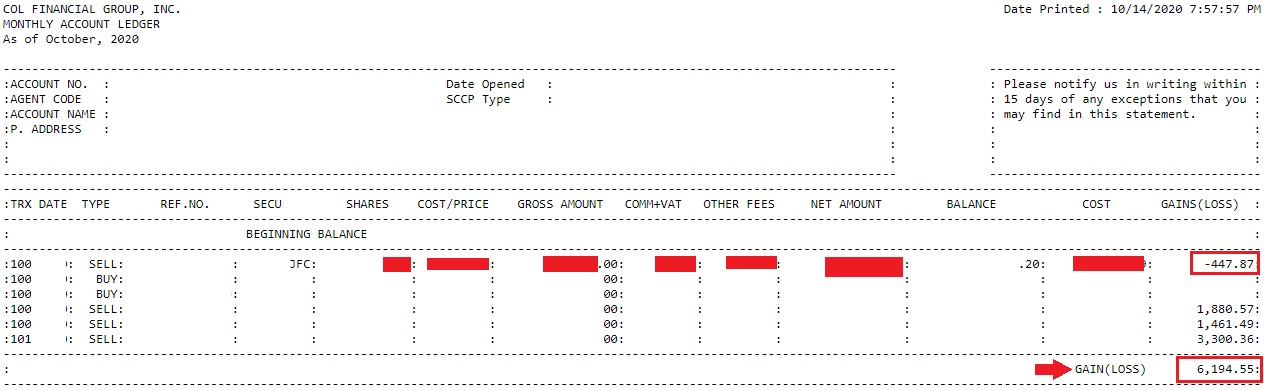

STOCK: JFC

➤using MA200 would give you already an over all view what the market sentiment is, if it starts to be on top of your prices then expect prices to dive and just wait for opportunities if price creates a strong base of support if you want to re-enter.

➤MA200 will serve as your resistance once price broke down this area and price now underneath, which already your signal to stay away at the moment and wait when price goes back to normal and your MA200 becomes your support.

➤if you insist of averaging down when market already on the down side then cut your losses first and wait for a strong support for your buyback.

No risk management

New traders/investors neglect to have a trading system, that is why I am not surprised to read some sentiments when they got trapped at the top or holding to a losing position because their "guru" told them to do so...or simply don't want to accept the fact that the market just turned against them.

"Antagal naman tumaas para makalaya na, tataas pa kaya mga pappy?, wala na akong bala kaka average down!"

The stock market basic concept is very easy to understand you just buy a particular stock and sell at a higher price to make profits, and if you are lucky to pick companies with dividends then enjoy your annual cash divs as bonus.

What's the catch?

The market won't reward you easily if you're not prepared to receive it, that is why it's a great challenge on how will you come up with your own system that makes you profitable and prove your worth before you get a piece.

Trading is not about getting perfect trades all the time or winning every trades you make, you need to sacrifice small amount of losses for you to get a better position that would reward you in the end.

|

| COL_Ledger |

Precision

I still bump on some new traders asking "What is the best entry for this stock?", "Is this a good entry already?" "Bottom na ba mga ser? Pwede na magbodega?"

In fact, there are no right or wrong choices as we never know what will happen next, that is why don't put too much emphasis on these, just get a price when you think it's already near its support and prepare to sell half when you think a previous resistance is about to be broken.

A quick sample scenario:

If a stock currently at ₱5.76 normal approach of most traders would wait for a pull back to ₱5.50 or lower, what if the demand next day is too strong that it created a gap up to ₱5.84 and closed at ₱6.81? Sometimes you don't need to "over" analyze.

So don't stress yourself if your entry point will be right or wrong just let the market do the worries and just follow when it settled to a certain level then set your target entry.

Be patient and don't rush without having any trade plans.

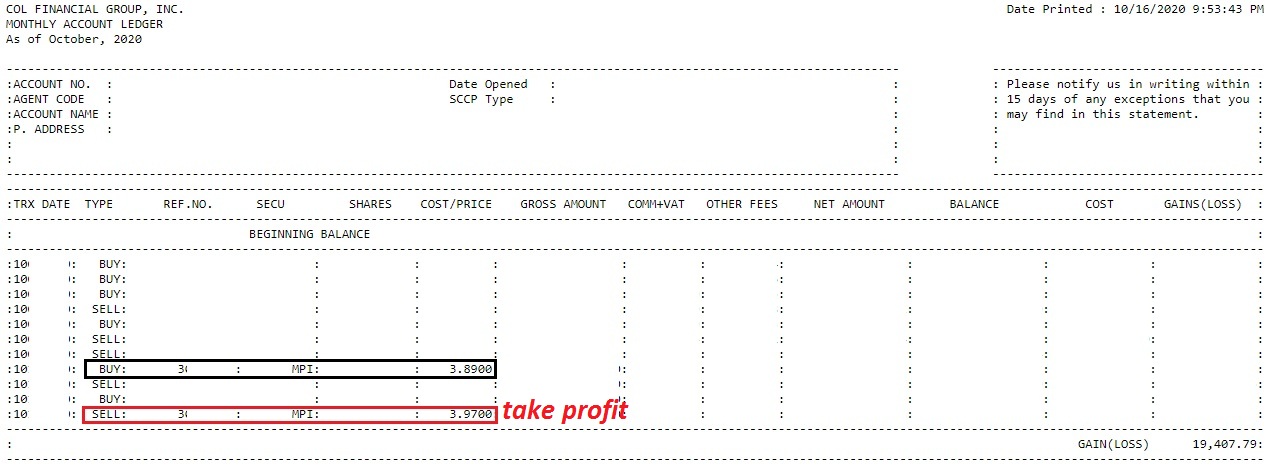

STOCK: MPI

➤do your homework to screen your stocks and start with a Weekly tf where support have been made.

➤check if it created higher lows.➤a breakout from a previous high (check if there is volume) you may test buy or wait for the next candle.

➤wait for an opportunity if there would be a sell off until price will settle.

➤watch the next candle if it opens higher from previous close.

➤set an entry just above the previous high then set the low of the candle as your CL.

Taking profit

|

| chart_from_investagrams |

"Ipit din si UBS at Macquarie, ok pa tayo mga kakosa!" "Hangga't di pa sila nagbebenta kapit lang!" these kind of comments from retail traders exemplifies another bad mentality towards the market.

Mind your own equity and not make use of these big players as your excuse to comfort your own losing port, focus and concentrate on your exit plan if you fail to add risk management from the beginning of your trade.

If they are also victims of this bull trap as you claim as "ipit", all of a sudden they start selling in tranches which in turn you as retail just watched the price dropped as low as it can get, then you get surprised when they are buying back.

"Kala ko ba "buy low" sell high, bakit ginagawa nila "buy high" sell low, haha" You may laugh now but once you are able to understand the rationale behind you might be applying it soon on your trades.

Trading is not only about buy and sell concept but also requires money management, they are not called fund or hedge managers for nothing, ever heard of window dressing before?

Remember you are in a market, cash back or cash rebates, does that ring a bell?

Get rich quick

New traders want to get rich right away or desire to catch big amount of profits, that whenever they enter a trade they go all in, if the trade fails they end up the same "hope and pray" mindset waiting for one jockey player to make a move.

“The stock market is a device for transferring money from the impatient to the patient”-Warren Buffett

If the trade comes out to be a winner, they become too greedy and fail to lock in their profits that if the market reversed it decreased their gains or worst comes to worst went back to their original entry price or even lower.

Don't get enticed quickly with traders showing millions of gains and aim quickly without a system, this is not about race to millions in a day.

Trading is about honing your skills to learn how to apply risk management as this will make you versatile on any market conditions regardless of what stock you may wish to trade and you can get your millions or more in time.

I got mine in 3 years because the market was bullish at that time but when the bears took over I got too careless because I neglected my system and got overwhelmed with the profits.

➤Don't rush to make money in the market, there's plenty of opportunities to come.

➤Practice buying and selling in tranches like what the big players do, be patient.

"Big movements take time to develop"-Jesse Livermore

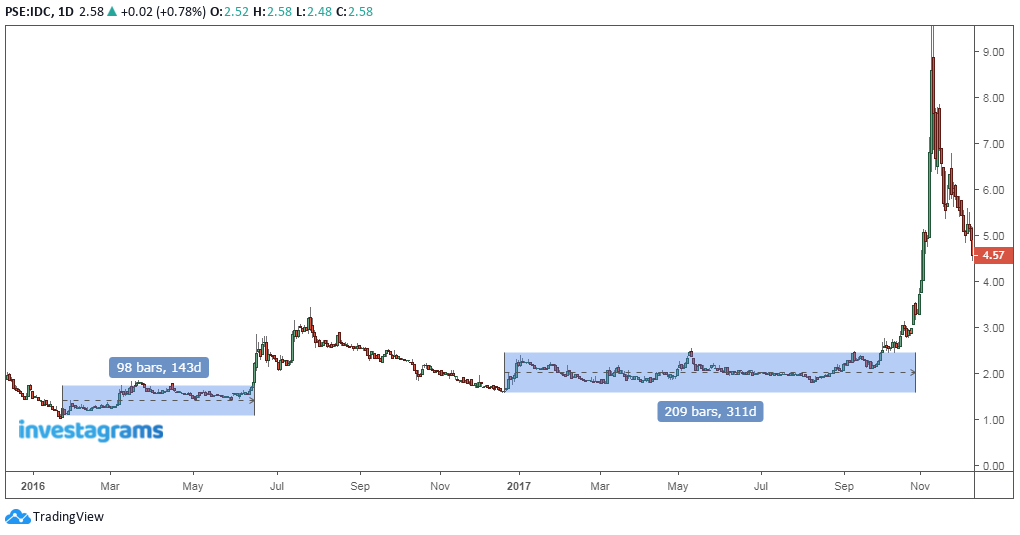

STOCK: IDC (big move sample)

➤accumulation and distribution➤it takes lot of patience to be able to catch such movements

STOCK: WEB

➤remember this stock?

|

| chart_from_investagrams |

The Search for Holy Grail

Most would focus on finding the best set up of indicators from Ichimoku, MACD, RSI, Moving Average etc when in fact these are recorded data from past price movements with different formulas and won't make a move unless there is a trade currently happening.

In short it will never tell you the next results until a trading day is finished.

When I started to study TA, I tried to study every indicator I could find like MACD, then I got too confident that it says that if there will be a crossover to take place it's my signal to buy.

Believe it or not when I tried to apply on actual trades even to the point that it was about to cross (as in konti nalang halos dikit na), I said aha I just found the holy grail!

To my dismay that crossover did not happen, it went the other way around and widen the gap further. I hate to disappoint you but you'll end up looking for something that does not exist.

If you believe that stock A is about to reverse because you see a ZS about to happen but no one wish to trade on that stock, will you still believe that there will be a reversal to take place?

Remember this, we trade with our own beliefs, if I believe that this stock is bullish because I spotted EMA50 just went below the prices then how come some are selling instead of buying?, because we differ in beliefs.

Simple "supply" and "demand" that move prices so never blame your indicators for these are just for adding odds to your trades for higher chances to make profit.

STOCK: ORE

|

| chart_from_investagrams |

When the market decides to make a big move your indicators are hopeless and have no control over the prices, your golden cross, MACD crossovers, moving averages below prices etc can be violated anytime in just a snap.

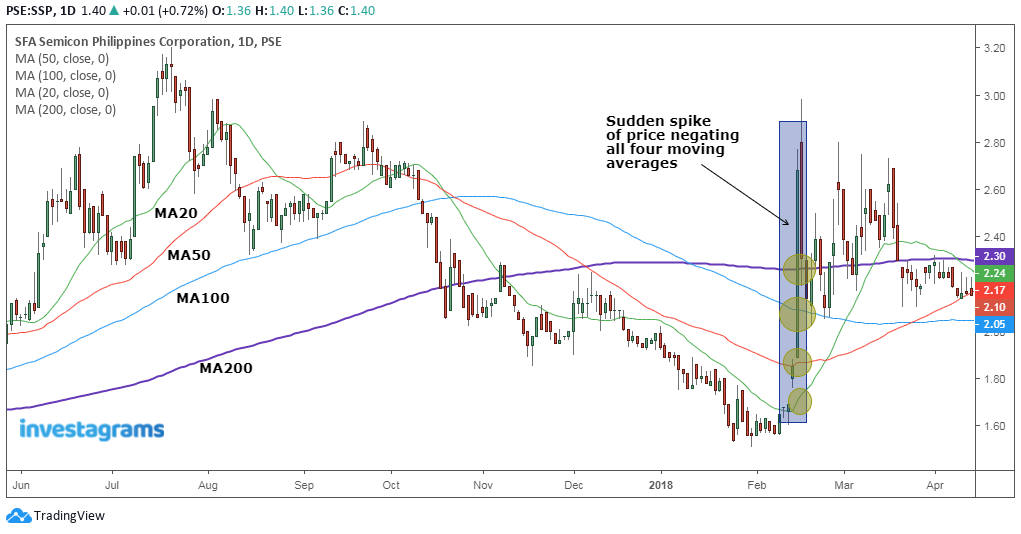

STOCK: SSP

➤look how the four moving averages acting as resistance were suddenly broken almost in one swoop.

STOCK: WEB

➤remember this stock?

➤this no longer needs TA as they named it as DA, any guess?

➤look how the gap down ate up the three major moving averages acting as supports without any warnings

|

| chart_from_investagrams |

Other samples would be on your own research on mining industries also suffered the same fate because of news regarding on a new head appointee.

Lesson about trading is not to rely your hopes on indicators but merely use it as tools for reference to get an edge and added conviction only (pampalakas loob).

Always remember that "anything can happen" and indicators have nothing to do with the next price movements, it will be decided by supply and demand the next day.

Diversification

If you have a small account, never listen to advise on buy stock A, stock B, stock C, stock D etc. for this will only lead to stress if all will be showing negative gains, rather minimize to 1 and maximum of two to start with.

I don't see this as diversification if you just invest on stocks alone with different sectors like industrial, property, mining, holding etc, I see it more as "overtrading" as all is affected if the market is down and by the word itself "Dive-rsification" may sound true on a bear market.

Overtrading is another bad habit you must avoid and will keep you awake at night plus the frustration every time you open your port with no progress, or worst if price keeps falling.

Final say...

“It takes a man a long time to learn all the lessons of his mistakes.”-Jesse Livermore

Indeed, after the past 4 years of my journey only I realized my mistakes and come up to my senses that trading the market is not about the amount of profit you can pocket on every trade or a perfect record nor the use of the best indicators for my stock picks, but how I execute my system and manage to minimize losses yet increasing my equity.

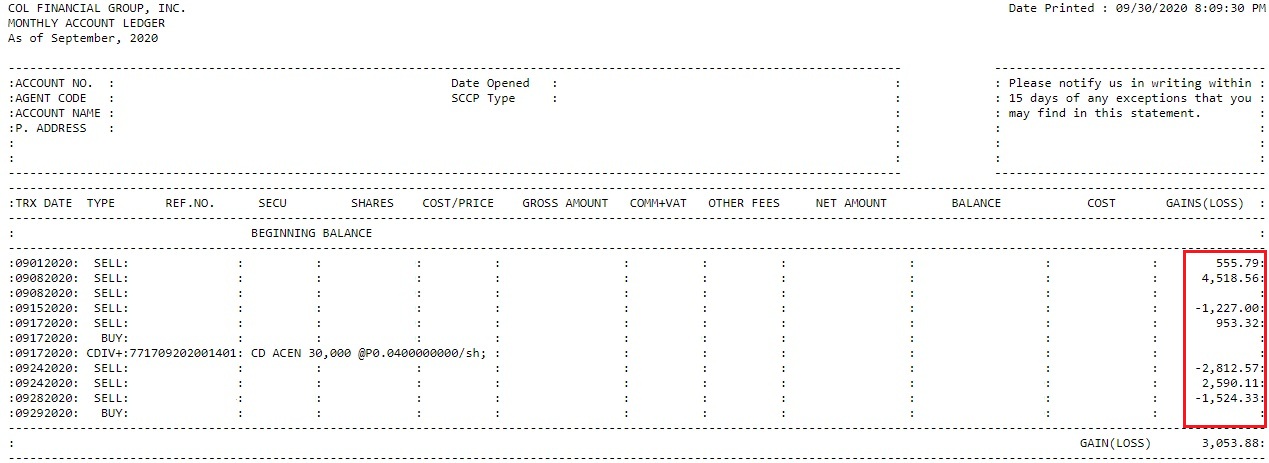

|

| trade_history_september_2020 |

Wish you luck with all your trades and try to remove the bad habits and start to trade like a pro.

0 Comments