BOBO and FOMO goes hand in hand in the market. The BOBO traders who buy when a previous high is broken and those patient ones have already accumulated beforehand.

Obviously latecomers who joins the party as usual the FOMO traders who will be caught at toppish levels when early birds starts to unleash and begin to take profits.

This cycle repeats each time a sleeping/dormant stock starts to make a big move, either from some disclosures/news or any factor that triggers the price to spike.

BOBO traders

➤for me they are like the vultures of nature, and FOMO are its meal.

➤like vultures, these market movers are just on top watching over the next retail traders who will be beaten up by the market until they dive to make a good feast.

FOMO traders

➤are those who have no system that jumps around one hype from another and fails to apply risk management.

➤they rely too much on quick movements expecting to recover their losses from previous trades or ➤impatient and aims for quick gains.

➤as the acronym itself, some traders just don't want to be left behind

Disclaimer: Sample charts provided are for educational purposes only.

Let's see some recent stocks who breakout from consolidation

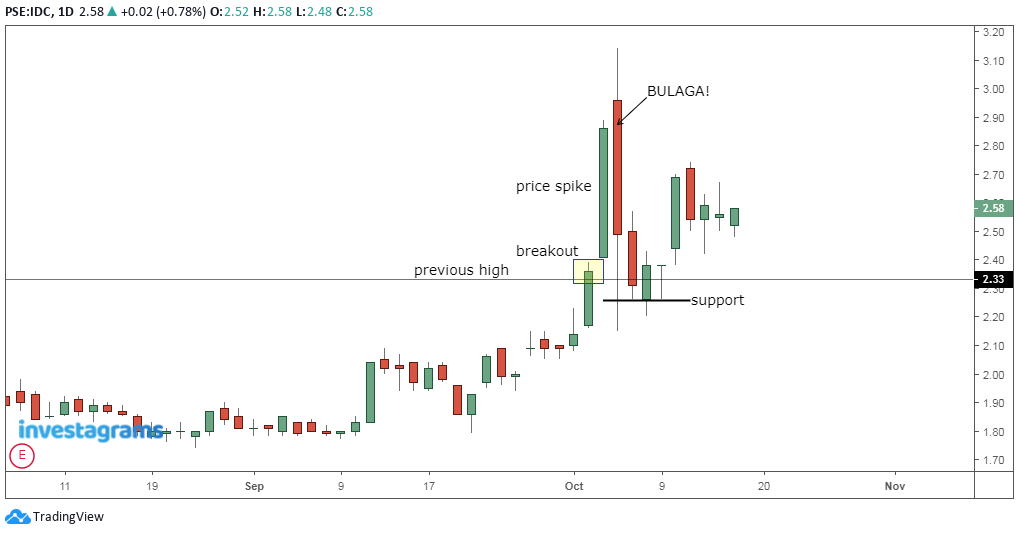

STOCK: IDC

➤if I may guess this might be triggered by the disclosure of stock dividends as of September 30, 2020

➤observe where it created its support, went back to the candle that broke out from its previous high (almost half of the candle's body)

|

| chart_from_investagrams |

STOCK: NOW

➤the fourth telco news obviously pump the adrenaline

➤pay attention to support levels going back to the breakout candle

|

| chart_from_investagrams |

STOCK: DITO

➤uncertain if this change of address disclosure triggered the traders or...

➤the continues disposal of shares from disclosures still drove the price up

➤support level like the other two above went back to the breakout candle

|

| chart_from_investagrams |

If you are an observant of these kind of plays and you happen to be the FOMO, look closely and learn from it.

Worst scenario you were caught at the top, then came the sell off the next day or the day you bought the shares itself, if your entry is already violated that is your signal to get out from the trap.

Remember you are playing breakouts and those who have accumulated before have started to take profits and they can easily pump the price by buying small chunks of shares to keep the price rising with less effect on their low average price.

Plus the more volume of shares they add up to their port will also increase their profits.

Look how support is created after the early birds started to lock in their profits, if you have exited earlier and anticipated the support levels you might ended up winning your trades instead of waiting for the price to come back at your entry price.

Want to learn how to turn the tables when caught in a bull trap or how to take advantage of the bear markets?

0 Comments