As defined by investopedia two types of institutional investors plays the market, the institutional and non-institutional investors.

I need not discuss in details but to give you a simple description about institutional investors are those organizations/companies who who offers life insurance, mutual funds, pension funds those pre-need companies if you are aware of are just a few categorized under institutional investors

In short these are organizations that pools funds from investors who trade and invest on their behalf, so if you have applied for a life insurance plan or mutual funds you might be aware that your investments are being managed by what they call as "fund managers".

In contrast, we small retail investors or individual simply trade and invest for our own personal account and only capable of minimal price movement in the market vs these market movers.

Therefore whenever you hear about institutions in the stock market they are considered the big players that can greatly influence the price movement in the market.

Aside that these institutions have more resources in terms of extensive research plus they can make negotiations and avoid paying fees on marketing and distribution costs from every trade, there is also the possibility of some trading between insiders before it is available to the public.

Since they have more reserves/funds pooled from number of investors against small/retail investors there's no doubt that they can manipulate by legal or illegal means as mentioned from this article.

These institutions are not limited to locals in the country but make watch of the foreign as well. What would be the relevance of trying to learn about these institutions are once they start to accumulate shares from a particular stock then you know the drill.

Here's a few lists of FOREIGN institutions you must watch out for their buying/selling patterns.

Aside that these institutions have more resources in terms of extensive research plus they can make negotiations and avoid paying fees on marketing and distribution costs from every trade, there is also the possibility of some trading between insiders before it is available to the public.

Since they have more reserves/funds pooled from number of investors against small/retail investors there's no doubt that they can manipulate by legal or illegal means as mentioned from this article.

These institutions are not limited to locals in the country but make watch of the foreign as well. What would be the relevance of trying to learn about these institutions are once they start to accumulate shares from a particular stock then you know the drill.

Here's a few lists of FOREIGN institutions you must watch out for their buying/selling patterns.

| 176 ABN Amro Asia Securities (Phils.), Inc. | Foreign |

| 255 Apex Phils. Equities Corporation *** | Foreign |

| 323 CLSA Phils., Inc. | Foreign |

| 142 DBP-Daiwa Securities SMBC Phils., Inc. | Foreign |

| 174 HDI Securities, Inc. | Foreign |

| 185 J.P. Morgan Securities Philippines, Inc. | Foreign |

| 121 Macquarie Securities (Philippines), Inc. | Foreign |

| 246 Summit Securities, Inc. | Foreign |

| 333 UBS Securities Philippines, Inc. | Foreign |

| 260 UOB-Kay Hian Securities (Phils.), Inc. | Foreign |

| 220 ATR-Kim Eng Securities, Inc. *** | Foreign |

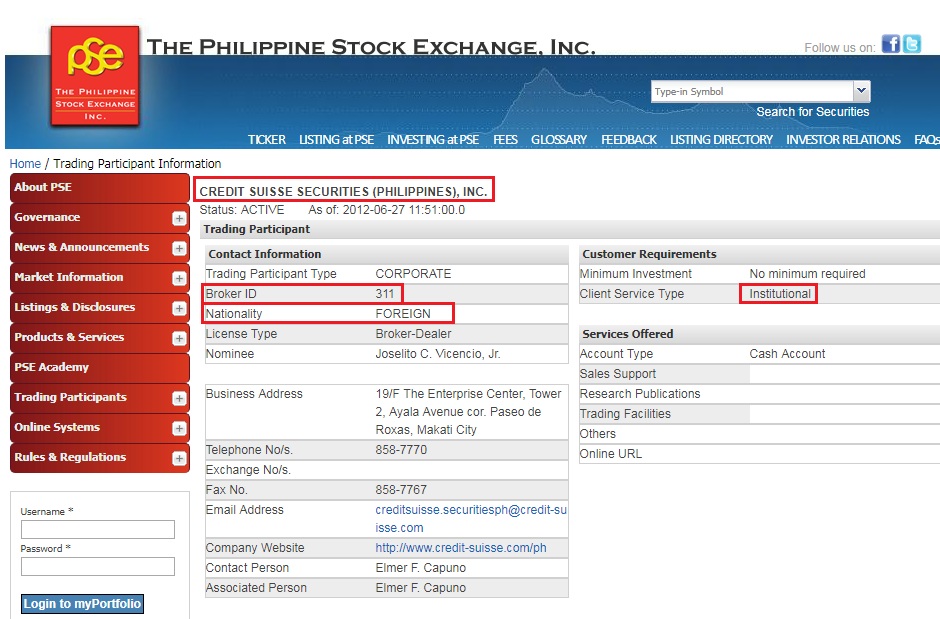

| 311 Credit Suisse Securities (Phils.), Inc. | Foreign |

| 209 Deutsche Regis Partners, Inc.*** | Foreign |

note:

***others tag them as local and not foreign

If I may add include Wealth and Goldstar Securities on your watch list.

Just try to consider this with their advantage of having great buying power that imagine if they can purchase 10M of shares at the price of ₱4.67 and merely a 0.10 ¢ increase will already yield huge profit for them that they can easily dump their shares.

|

| 10_¢_increase_profits |

You may try to check it out from PSE site for verification and updates for active institutions

|

| institutional (http://www.pse.com.ph) |

Final say you may keep an eye on these players especially when they try to buy volumes of shares (accumulation stage) from a certain stock and be on guard when they try to sell as it will be a great drop in price once they dump but remind you not to neglect your own system.

It's like a domino effect when retailers see these players selling they quickly join the crowd which causes panic and definitely a sell down on a particular stock.

I'm sure by now you already heard traders making jokes like this: "ipit", palit selda, "nabuhusan", "nakalaya na!" etc.

At the end of the day do your part and research and check from your own system if you want to ride these jockeys or not.

If you rely too much following them you might not be able to hone your skills as trader but an idle "newbie" trader without its own system.

To get a picture how these players make an impact to a particular stock price check this post here.

If you find this helpful, say thanks by sharing this site to others!

0 Comments