Almost all of the famous traders I had searched online only have one thing in common, they don't average down but they do average up on a bull market.

A classic sample of traders that average up would be Darvas and Livermore if you have read about their stories on how they try to ride the bull market and cut their losses if it goes the other direction.

The more they add to their shares even if an increase on its average will still bring more profits vs going for average down on a down market.

Make sure you buy in tranches and not one time purchase to have some reserves if the market outlook is more on positive side.

Disclaimer: Sample charts provided are for educational purposes only.

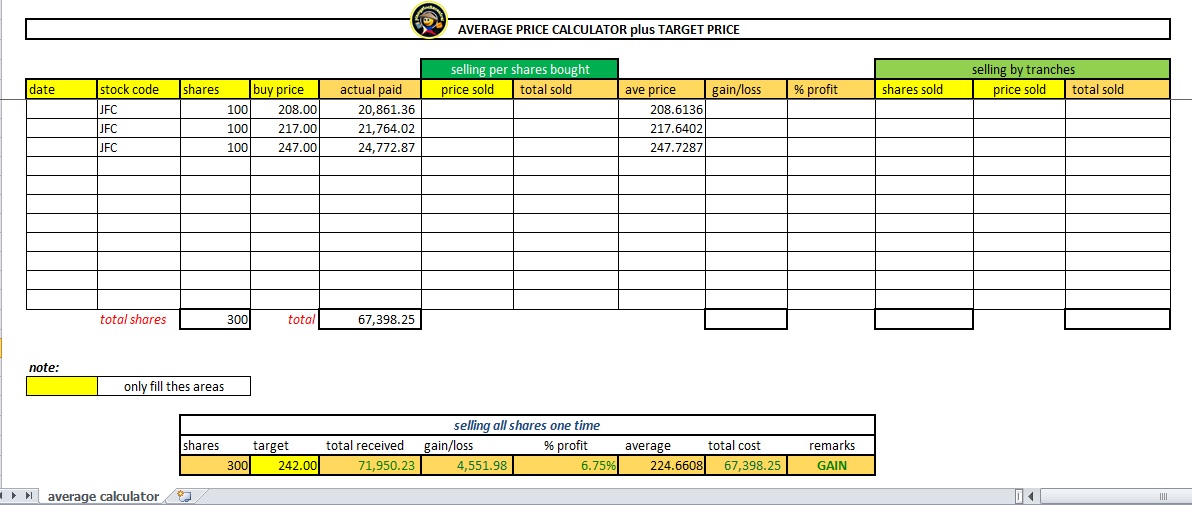

Let's try to see one sample stock computation if this really works

STOCK: JFC

➤one time purchase only and say you just follow the trend before selling when you feel its about to break its old support.

|

| chart_from_investagrams |

This is the amount you gain from a one time purchase after selling.

|

| chart_from_investagrams |

This is how much you profit with average up after selling.

You can see the difference that there would be an increase in your profit even if you keep on adding shares higher from your previous as long as you notice the market is going up.

Try to compare this with the average down on a down market from this post and assess to yourself which would benefit you most, is it adding up more on uptrend or adding more on downtrends?

Final say always make the habit to take your profits as you'll never know when the market will go against you.

0 Comments