Once you find an edge and applied some risk management to your trade plans, it would be best to add the habit to monitor your portfolio regardless if you're a trader/investor as you need to be up to date with the trend of the market.

Once you find an edge and applied some risk management to your trade plans, it would be best to add the habit to monitor your portfolio regardless if you're a trader/investor as you need to be up to date with the trend of the market.

As an investor you can not simply buy one time volume of shares and just sleep over and wait for 5 to ten years for your money to grow.

What if you have missed out opportunity of sudden decline of prices which could have lowered your average price even more?

Monitoring your portfolio once in a while won't hurt, it will help you filter out companies that are profitable from short period of time vs companies that took you a year and still in negative gains.

Since I do trading it helped me a lot to observe what stocks that I can easily watch over the next few days or weeks that I can buy and sell again once the price drops.

Just put it like as your diary where you can add some notes etc.

Just put it like as your diary where you can add some notes etc.

Disclaimer: Sample charts provided are for educational purposes only.

To give you a concrete example say you purchase Bloom during the time when it skyrocketed from ₱102.80 (2011) then started to drop from succeeding years until the present date (as of this writing), you may say you hold your position for long term but would already miss out profitable stocks than Bloom if you fail to monitor your portfolio.

|

| bloom_chart_history_(chart from Investagrams) |

Take another classic example of JFC (Jollibee) when it went as high as ₱300+ only to drop to ₱245+ which would already cause your port 18%+ loss if you failed to monitor your port.

|

| JFC_chart_daily_(chart from PSETools) |

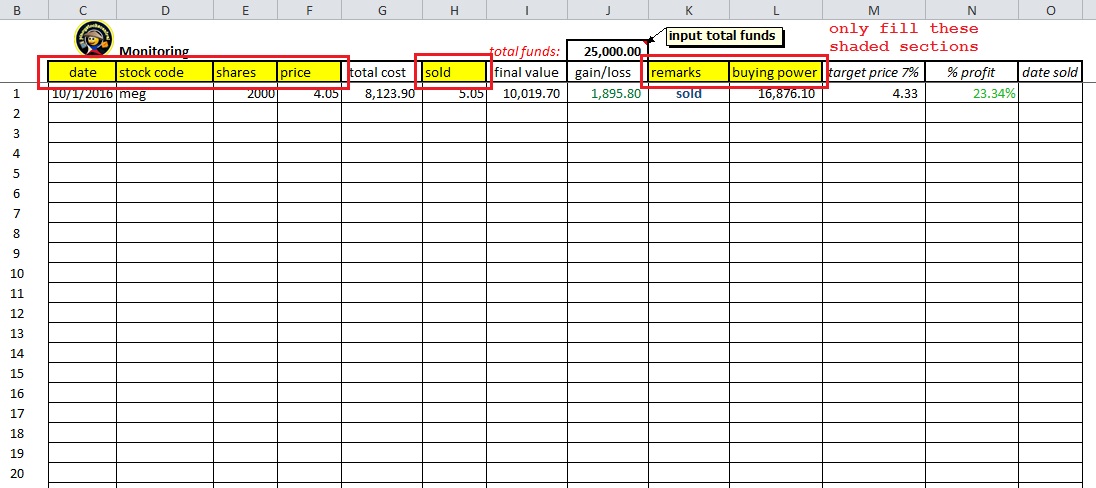

So what I did was to make my own monitoring sheet in excel file with the date of purchase and I always place the date when I sold a specific stock (hidden as inserted comment).

I also incorporated the computations with fees from my broker (COL Financial) and could easily play around with my target price and can forecast when to sell my stocks.

|

| Monitoring Sheet Excel |

You can make your own monitoring sheet in excel, to those who wish to have this excel file you may now download from below.

|

| monitoring sheet |

Lastly having your own monitoring sheet will help you in your future trades where you can easily review what you did to make a "good buy" or a "good bye" stock that you can rinse and repeat the good ones.

note: fees updated on TRAIN law you may also refer to stock market calculator for reference.

note: fees updated on TRAIN law you may also refer to stock market calculator for reference.

If you find this helpful, say thanks by sharing this site to others!

5 Comments

Thank Sir..this is a great help to me

ReplyDeletesir super salamat sa blog mo..laking tulong para matuto at may pagaralan na lessons..godbless po and sana magupload po kau lagi ng bagong mga lessons para sa aming mga newbies

ReplyDeleteglad to help mga sirs/ma'ams, once you have gone all posts (list of recent posts to your right) using PC to view then I'm sure you will manage to make money in the market, no need to over analyze as price will always be moved by the market not TA and FA or other market analysis methods, as long as meron na kayong edge (methodology) combined with defense (risk management) surely you will be able to go with the flow of the market. Will post soon if I find some worth while topics that may benefit us all. Happy trading! :)

ReplyDeleteSalamat po

ReplyDeleteyou're welcome, happy trading!

Delete