If you really desire to make money in the market, then pay attention and impart this in your system well. To cut the story short, I had given more focus on the amount of gains that I will pocket and worry how to lower my average on losing stocks rather than improving my skills to trade.

Only to found out that I am banking more on my losses instead of gaining, add up the emotion that is built up unconsciously when I made my trades.

As early as possible be vigilant more to your Equity's progress. Your equity is simply your total balance remaining plus your floating profit/loss from your open orders.

Why is your equity so important?

Simply because your equity reflects on how you perform with your trades, if you are making bad calls without a doubt it shows immediately on your port and affects your total equity.

Say you funded your account with the amount of ₱100K and decided to trade at least two stocks to test how it works, by all means try to limit your loss to a max amount ₱500-1000 for you to have a feel of the market.

If both on a losing position then close and exit your trades if it reached your cut loss point, if one makes a profit and the other on loss then close the losing position along your stop loss point while keep your winning position.

The more you prolong your loss and neglect to get rid from your CL will only bubble until you could no longer bear the pain and decides to be an investor.

Worst case scenario if you listen to tips that says "oh its fine the market will recover, just keep adding up while at a bargain price".

If you do, then you only burden yourself with sleepless nights thinking about your negative port. I'll discuss in another topic why "average down" is a disaster to both traders and investors which I am guilty too after learning the hard truth through my journey.

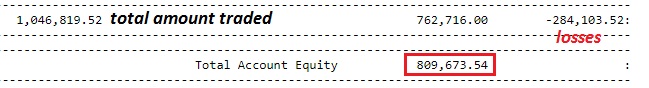

Here's a sample to let you have a better picture, I already profited before with 6 digits with one stock that I got too careless and didn't paid attention to the other losing stocks instead of cutting it short I added more thinking that it will reverse soon.

End result that 6 digits turned 5 digits or even less due to the negative stocks that I am holding which I keep on adding shares.

If only I focused on my overall equity I would have not let my guard down and let my emotions over those losses and could have get rid of it right away.

At all cost protect your "Equity" and focus not on the amount of gains/loss per stock as it becomes a bad habit that you forget your goal to protect your funds and capital growth.

Still does not make sense?

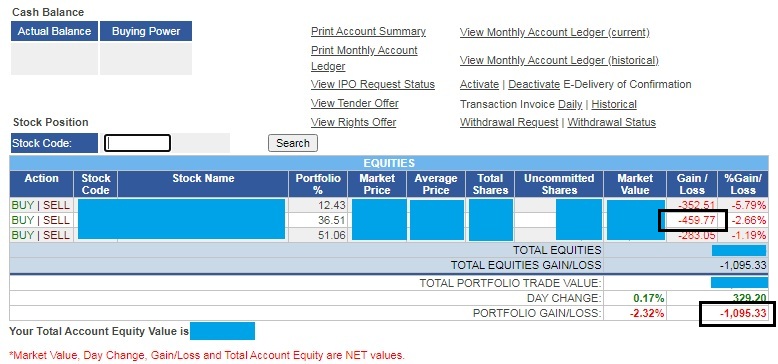

➤earnings for the first 3 years of trading with 54% that amounted to millions which resulted to complacency is clearly reflected on how the equity is being eaten up by the unchecked losing positions.

Do not concern yourself on every stock you trade to always exit with a profit or you end up with no plans to get out which in turn will hurt your equity.

Check out this sample:

➤I get rid of one stock that I was holding for more than a week without progress

|

| portfolio |

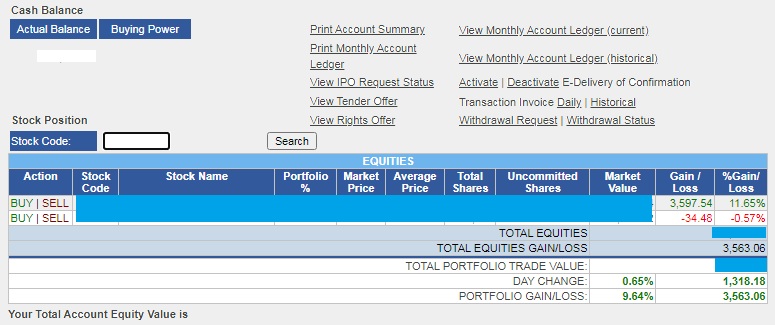

This is after I disposed that stock

|

| portfolio |

Went ahead and traded another stock that I saw an edge, but could have made a buyback also to the previous stock I get rid of earlier.

|

| portfolio |

This feeds and fattens my equity :)

|

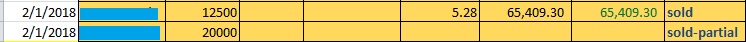

| ledger_COL_financial |

My rules on Equity when I trade:

Rule No. 1: Protect your equity

Rule No. 2: Never forget rule no. 1

Think of your equity as your "precious" and by all means don't let someone take it away from you, or think of it as your trophy that out of number of players in the market you standout and became the winner.

Final words...

When it hurt your equity it hurts your feelings you get emotional and that is enough to clutter your decisions.

0 Comments