Same concept with cash dividend you need to hold shares before the given ex-date and can start selling on ex-date itself with guaranteed stock dividends on the given payment date.

Same concept with cash dividend you need to hold shares before the given ex-date and can start selling on ex-date itself with guaranteed stock dividends on the given payment date.The only thing with stock dividends on ex-date there will be some price adjustments, so depending on the company who will be giving stock dividend can announce if there will be dilution to take place or not, like CPG who declared that there will be no dilution to take effect on ex-date when they announced for a stock dividend.

For some reading on stock dividends you may check this link (here).

For companies that will issue stock dividends without any news if it is non-dilutive then as a rule on ex-date price per share will be diluted (similar to stock split).

For companies that will issue stock dividends without any news if it is non-dilutive then as a rule on ex-date price per share will be diluted (similar to stock split).

Let's make some example:

STOCK: TUGS

➤50% stock dividends ex-date September 14, 2017

➤Payment date October 13, 2017

You bought TUGS of 10,000 shares @ ₱3.05 at closing of Sept. 13, 2017 amounting to ₱30,589.98 (fees included-get your excel calculator here).

To get your average simply divide the total amount you paid with the total number of shares.

₱30,589.98/10,000 shares=₱3.059 (your current average)

Since the closing was ₱3.05 divide this with 1.50

₱3.05 /1.50=₱2.03 this will be reflected as new price adjustment per share the following day which is on ex-date from your broker's platform.

TAKE NOTE: Your current average of ₱3.059 and number of shares of 10,000 shares will stay the same on ex-date no changes yet until the payment date.

Opening on ex-date is at ₱2.15, went up as high to ₱2.45 and low at ₱2.03 closed at ₱2.30, you are at a loss obviously on ex-date due to price adjustment at a negative percentage of 24.81% on closing price.

formula:

current average less adjusted price on opening = _______x100

current average

computation from its opening price

₱3.059 - ₱2.15 = 0.29715 x 100 will give you roughly 29.716% loss

₱3.059

On payment date reflected on your port will be this:

10,000 shares x 1.50=15,000 (new shares)

₱3.059/1.50=₱2.039 (new average)

Depending on what will be the current market price traded on payment date you can easily know if you gain or not by making advance computation to your adjusted average and can decide if you will sell on ex-date at a loss and wait for your dividends to arrive and manage to sell at a higher price to recuperate your losses.

As per October 13, 2017 payment date the opening price is at ₱2.40 high ₱2.41 low ₱2.25 close ₱2.30, any of the prices compared to your adjusted average you are already guaranteed of profit at 10.35% at the lowest price.

The market will decide if they find it attractive on its price adjustment on the ex-date so make sure to do your own homework on your computations.

STOCK: IDC

➤45% stock dividends ex-date January 10, 2018

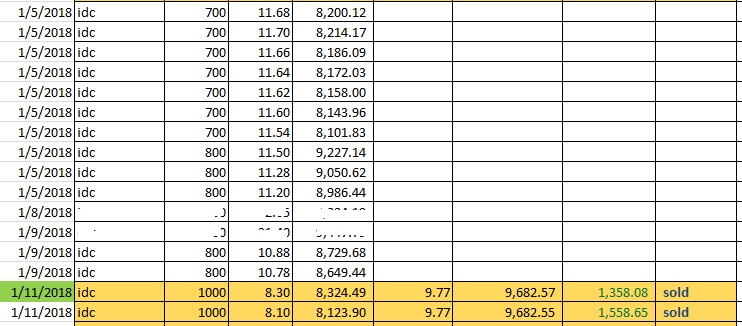

I had some previous shares before last December but I simply sold all my shares when the price spiked to around ₱14+ before I came back and anticipated the 45% stock dividend on ex-date as shown with a total of 8,900 shares.

Price adjustment took place on ex-date January 10, 2018 with previous closing price of ₱10.80 and the reflected market price on ex-date was ₱7.44 (from ₱10.80/1.45) but the opening price at that day was ₱7.99 per share.

I sold shares I bought after ex-date when it spiked around ₱9.77 as these shares are not included in the 45% stock dividends.

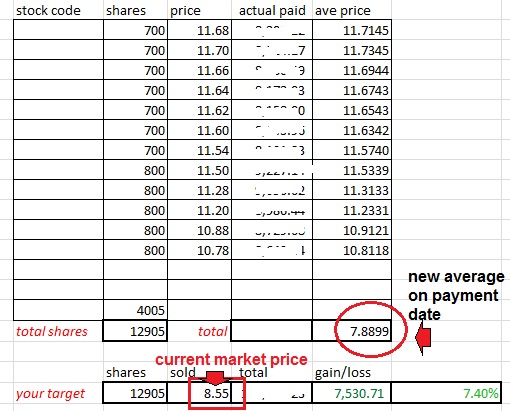

Here's my anticipated average price on payment date at ₱7.8899 when I will be receiving the 45% stock dividend of 4,005 shares (from 8,900 shares x 0.45) that would give me a total shares of 12,905, given the current market price at ₱8.55 (January 26, 2018) still I can already see some profits of 7.40%

Price adjustment took place on ex-date January 10, 2018 with previous closing price of ₱10.80 and the reflected market price on ex-date was ₱7.44 (from ₱10.80/1.45) but the opening price at that day was ₱7.99 per share.

I sold shares I bought after ex-date when it spiked around ₱9.77 as these shares are not included in the 45% stock dividends.

Here's my anticipated average price on payment date at ₱7.8899 when I will be receiving the 45% stock dividend of 4,005 shares (from 8,900 shares x 0.45) that would give me a total shares of 12,905, given the current market price at ₱8.55 (January 26, 2018) still I can already see some profits of 7.40%

|

| IDC_accumulation_in_tranches_with_45%_dividends |

Given above sample of 8,900 shares with an average of ₱11.4404 I can opt to sell when it went up high as ₱9.80 (January 22, 2018) with a loss of -₱15,380.44* or a negative percentage of 15.11% and when I receive my 4,005 shares if I can sell at an average market price of ₱6+ will be on profit.

*base from calculator computation with fees (old 0.5% sales tax)

loss of -₱15,380.44 when sold at ₱9.80

For the 45% stock dividends even if sold at ₱6.00+ per share...

4,005 shares x ₱6.00=₱23,814.93 (fees included)

(₱23,814.93-₱15,380.44)/₱23,814.93=0.35417 or simply 35.417% profit (₱8,434.49 gains)

RECAP

Given you have 100% holdings of a certain stock then they declared to give out additional 45% stock dividends then simply add 100%+45%=145% which can be converted as 1.45 as multiplier and divisor.

*base from calculator computation with fees (old 0.5% sales tax)

loss of -₱15,380.44 when sold at ₱9.80

For the 45% stock dividends even if sold at ₱6.00+ per share...

4,005 shares x ₱6.00=₱23,814.93 (fees included)

(₱23,814.93-₱15,380.44)/₱23,814.93=0.35417 or simply 35.417% profit (₱8,434.49 gains)

RECAP

Given you have 100% holdings of a certain stock then they declared to give out additional 45% stock dividends then simply add 100%+45%=145% which can be converted as 1.45 as multiplier and divisor.

formula:

➤number of shares x 1.___ =new shares

➤average price / 1._______=new average

Sample:

If company announced to give 20% stock dividends, multiply your shares with 1.20 and divide your average price with 1.20

If company announced to give 35% stock dividends, multiply your shares with 1.35 and divide your average price with 1.35

and so on...

Stock dividends are almost in a form of a stock split as there will be price adjustments that will take place on ex-date to look more attractive to buyers or investors.

➤number of shares x 1.___ =new shares

➤average price / 1._______=new average

Sample:

If company announced to give 20% stock dividends, multiply your shares with 1.20 and divide your average price with 1.20

If company announced to give 35% stock dividends, multiply your shares with 1.35 and divide your average price with 1.35

and so on...

Stock dividends are almost in a form of a stock split as there will be price adjustments that will take place on ex-date to look more attractive to buyers or investors.

Good luck on your dividend plays!

0 Comments