Most of us don't want to lose money, that is a natural reaction when you are in the market. That is why whenever someone hear about the word CL they tend to neglect to apply it in their trades and rather hold on to their losing port that makes them more comfortable to bear with.

Even if you don't focus much analyzing the market as long as you know how to handle your funds surely you will still succeed.

We make use only of the charts to get us a clear map what is happening on a particular stock, we need to get the overall trend who are dominating the market is it the bulls or the bears?

I always use the weekly to check its progress with the aid of EMA40 or MA40 doesn't matter we only need to confirm the trend who has the greater advantage.

Disclaimer: Sample charts provided are for educational purposes only.

STOCK: NOW

➤looking at its previous weekly chart you can already get the story where the major resistance is.

➤notice also where your EMA40 positions during a breakout and when it was broken.

➤since 2016 this is the 2nd time it made a successful breakout from its strong resistance level, this time our EMA40 is holding as support.

➤we can now be more confident that the bulls are making its move after a two years domination by the bears.

|

| chart_from_investagrams |

Let's look at the Daily chart

➤you can use EMA100 for the daily and get in position if it dives below your price.

➤but say you tried to go for breakouts then that won't be a problem.

➤worst case you're a FOMO trader who loves to catch the top of the breakout, then there's still a way to make money.

➤this is where CL comes in, instead of the term cut loss, I call this as CB or cash back (the word itself sounds more pleasant to your ears than cutting your losses)

➤yes you will get your cash back literally as the word implies and forget the worries of your losses.

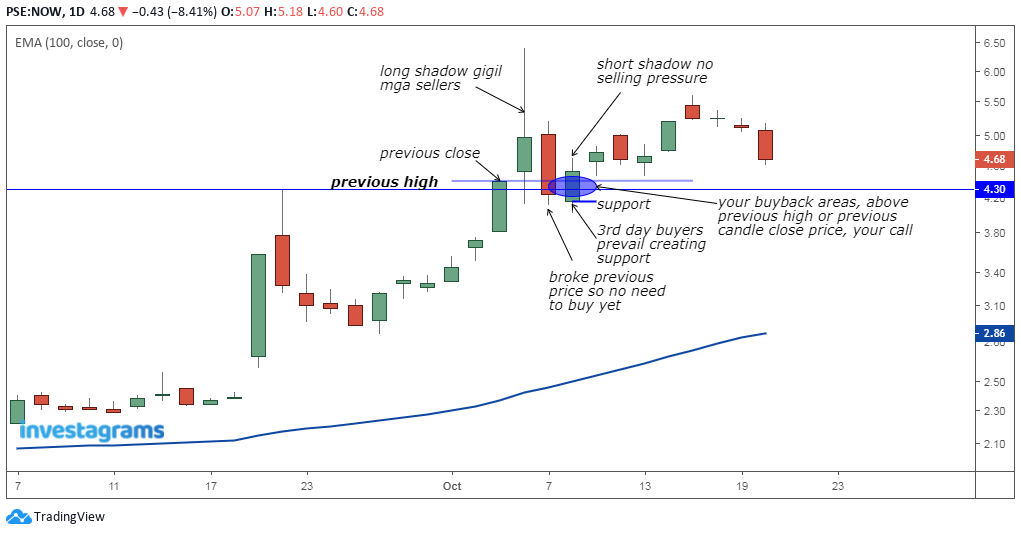

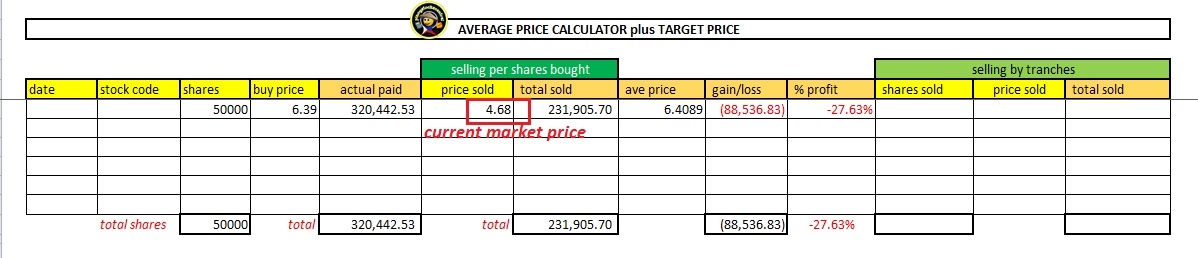

➤say you bought at the top of ₱6.39 the worst scenario then it suddenly drop.

➤given you have no plans when you trade this stock but just ride the hype of the breakout, then do your cash back somewhere at ₱6.35 or if you did not manage then along ₱6.25 or worst at ₱6.00 flat.

➤wait and observe the next candle specially if the previous candle created a long shadow which means there was strong selling pressure that occurred that's why you got trap on top.

➤if selling continues then just watch as low as it can get do not rush.

➤the 3rd candle you must watch if selling pressure still continues or if it starts to settle and creates a base of strong support.

➤now get ready to get in and do your buy back if buyers starts to overwhelm the sellers.

|

| chart_from_investagrams |

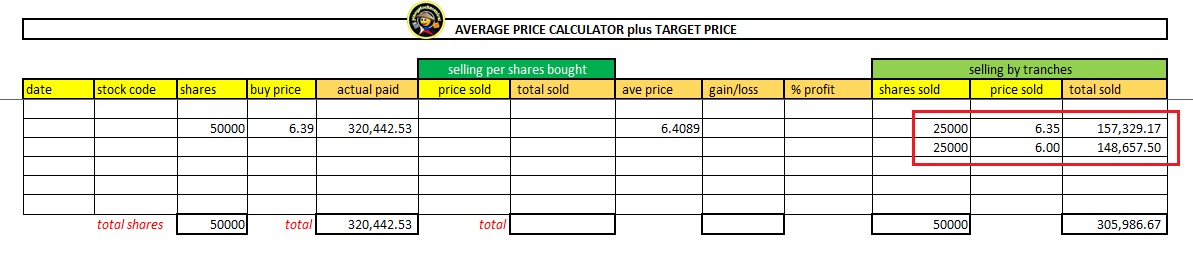

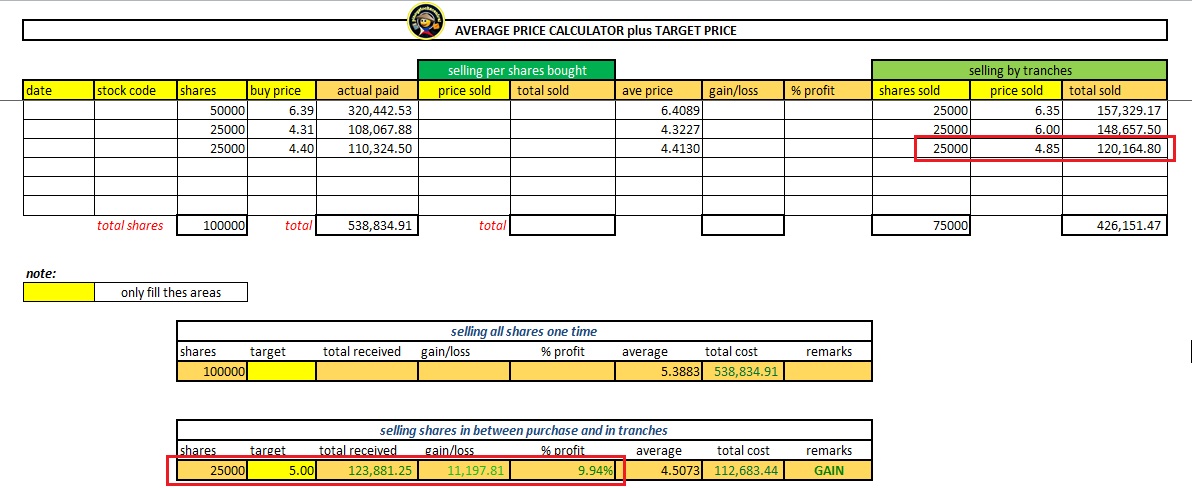

➤say you're the worst trader who goes for FOMO and all in and placed 50,000 shares at ₱6.39 but price drop and you sold half for ₱6.35 then still price drops and you sold the other half at ₱6.00

➤why half for obvious reasons if price goes up you can sell the other half to get profit, the other half your bullet to get back in the game if price continues to drop.

➤for this sample price keeps falling and no choice you need to make your cashback quick.

➤you get ₱305,986.67 cashback in return. (real cash at hand)

➤set aside your emotions about the loss and focus on your game plan.

➤now let's move with the buyback areas and we patiently wait for an opportunity.

➤as for this example finally on the 3rd candle after the breakout there was a sign of strength and support was formed already with less selling pressure with the short shadow/wick.

➤now you can opt to go for the whole 50,000 shares buyback or do it in tranches in half, your choice.

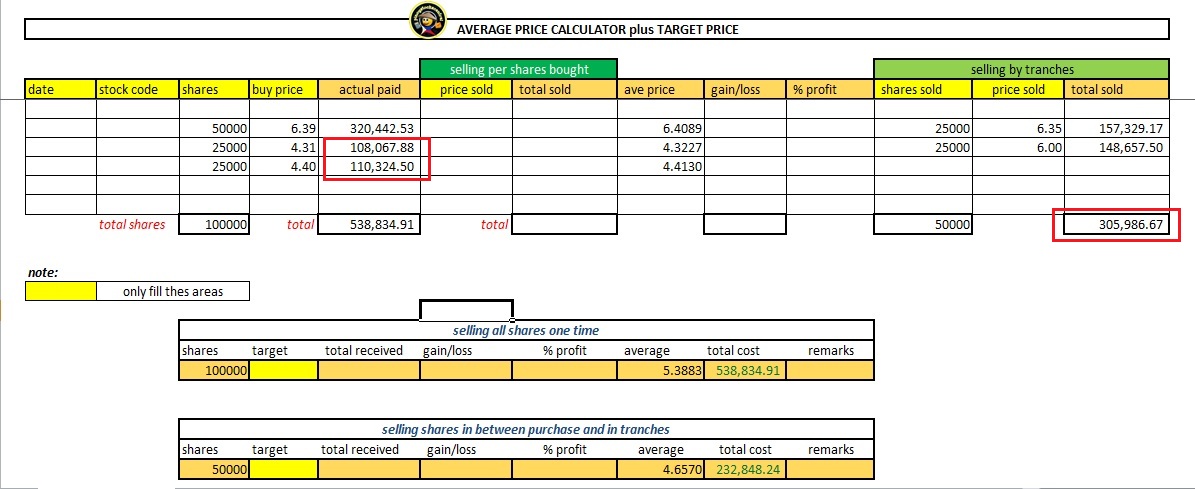

➤you have a total of ₱305,986.67 and say you pick half along ₱4.31 just above the previous high and the other half from ₱4.40 from a former candle closing price

➤you spent a total of ₱218,392.38 for total 50,000 shares

➤was that a good deal? you get your 50k shares back at a discount when you sold your shares earlier and how much discount did you get?

➤₱87,594.29 excess from your cashback of ₱305,986.67, is this a profit or what?

➤disregard the ₱538,834.91 since you just re-use your cashback to repurchase and didn't came as additional cash from your pocket.

➤the total cash you spent is this (original cash) ₱320,442.53 less ₱305,986.67 (cashback) = ₱14,455.86 (loss) + ₱108,067.88(buyback) + ₱110,324.50 (buyback), total of ₱232,848.24

➤₱232,848.24 divide with 50,000 shares you get your average of ₱4.657

➤your average of ₱4.657 includes already your first purchase with a loss, so this is your parameter to help you break even or make profit.

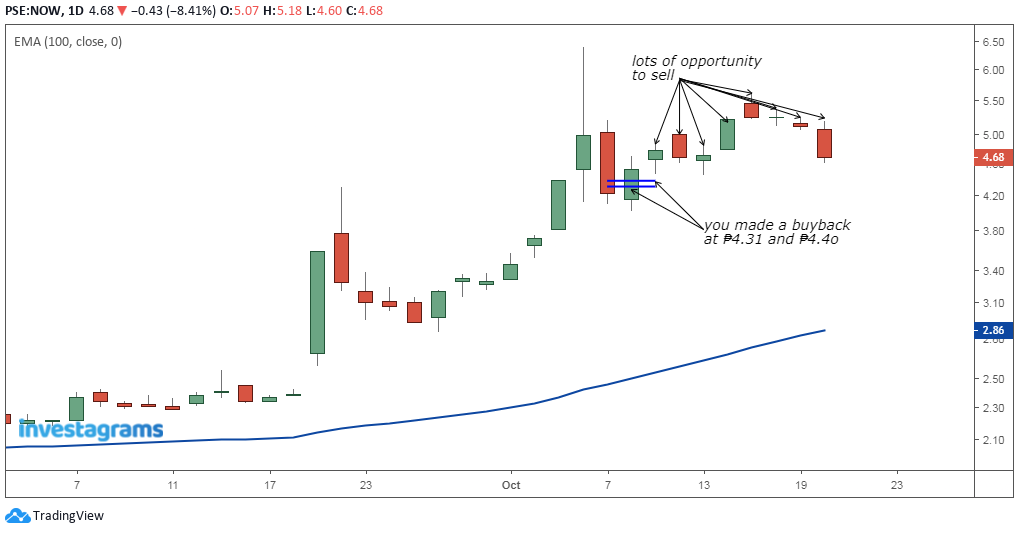

➤the market gave you ₱4.85, ₱5.02, ₱4.87 and so on which already your chances to grab, which you can again start selling from tranches by half.

➤you sold half in ₱4.85 = ₱120,164.80

➤you sold the other half in ₱5.00 = ₱123,881.25

➤total sales of ₱244,046.05 higher from what you spent ₱232,848.24 with a clean profit of ₱11,197.81

Or you can be the lazy trader who holds to your losing position with the hope and pray na babalikan ka sa ₱6.39 (bad habits) ansakit sa mata di ba?

Summary:

➤first purchase ₱320,442.53 (amount you release)

➤cashback ₱305,986.67 (amount returned)

➤loss= ₱14,455.86 (forget this with your worries)

➤spent for buyback ₱218,392.38 (exclusive of your loss)

➤cashback less buyback = ₱87,594.29 excess cash at hand

➤total sales of ₱244,046.05 received

➤total sales + excess = ₱331,640.34 cash at hand

➤cash at hand greater than what you spent on your first purchase, winner!

That's how you manage your port when you got caught up on top, without the worries of sleepless nights. If you decide to cling on your hope and pray habits the more you get beaten by the market.

Is this applicable on bear trends? Be my guest, go over the process and tell me.

Final say, do the cashback as soon as possible and wait for that golden moment when the odds is within your favor, the technical side is just your added conviction, how you manage your money from a losing position can be flipped to your advantage.

Remember the magic words, cashback>strong support>buyback>take profit.

Find this helpful? Click the donate button :)

0 Comments