I started without any background or formal training nor attended seminars at all when I started with the stock market but simply relied on what I read and watched over the internet.

I started without any background or formal training nor attended seminars at all when I started with the stock market but simply relied on what I read and watched over the internet.

We are now in the digital age so I just simply took advantage of this since information is accessible to any parts of the world with the use of the internet. Just make sure to filter out those unnecessary data that you may bump into but focus on the most important parts.

Any ordinary citizen who will be willing to persevere and willing to learn on the ins and outs from the market can make some profit.

What compelled me to open an online account only this 2016 when I remembered again what my sister told me 7 years ago (which I failed to do so obviously even when I already printed out and signed up an application form last three years ago but got lazy to go to our local post office to mail it) and keep reminding me before, "mag invest ka".

As I said to myself, invest? where? how? Those are the questions running in my head during those years. Somehow I did open up some mutual funds from BDO (UITF), and some from Sunlife Financial which I am aware of that fund managers invest some portions into stocks.

I already heard about the stock market before but just don't know how to start and did not bother to take a step ahead to open an account.

As far as I can remember all I heard about the stock market was all about risks, that you will lose your money and all about the negativism etc. My brother who happens to be enthusiastic about Forex also keep telling me to learn how to read charts that I can earn faster than from the stock market.

So eventually I just kept browsing over the net until I came to watch someone doing a step by step trading showing stuffs on some companies like 2GO, JFC, GMA7 and so on, as he is more particular on the ten cents price increase that will give you some profits.

I even read some eBook like about the story of some maids investing in the stock market, though I did not partake with the monthly subscription and not a member of their group.

I said to myself last May 2016, Ok let me try and give the stock market a shot. I reprinted another form filled them up and this time forwarded to their office via LBC, waited for some notification thru my email and they requested for a short Skype interview just to confirm some details.

At last I received my log in details a day after and immediately funded my account via online transfer from supported banks. My very first stock was not even listed under bluechips and was able to sold that stock the following day with a net profit of ₱155.48

The next two days bought another stock and after 4 days I sold it when it hit ₱449.37, goes on with the 3rd day re-bought the 1st stock I had on my first day and sold the next day at ₱53.93 profit.

Basically, those winnings are actually associated with "luck" since I did not read any charts that time since I don't even know how the chart works. Given that its pure luck, somehow you as novice (including myself) should already get a picture of important lessons that you should apply when trading or investing in the stock market.

Lesson:

➤learn to take profits and exit as early as you can, rinse and repeat.

➤learn to read charts to know where supports and resistance are formed.

Notice that I sell after a day or less than a week when I see some gains which you can apply depending on your risk appetite and Greed.

A gain will always be a gain no matter how small amount it is, its still counted as "precious" gains. You can just imagine with ₱53.93 you can already buy some shares of stocks that cost from any price range of ₱0.20-50.00 per share.

Small amounts of profit to be accumulated and can be used to repurchase another set of stocks later on.

Basically your rolling over those small profits again and again and if you consistently duplicate every small amount of winnings it will be summed up to a larger amount without you even noticing it from your portfolio.

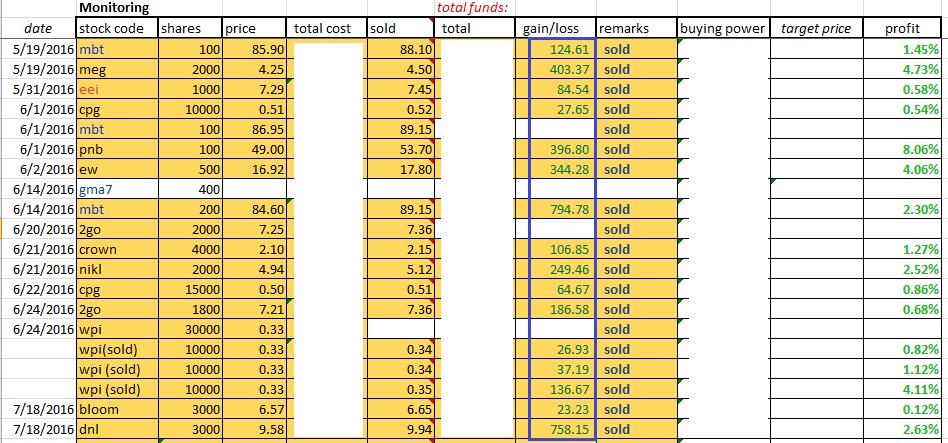

|

| monitoring_sheet_excel |

The following months some stocks where based from brokers guide like in COL Financial well known BBP (Buy Below Price) which was a big mistake as I explain later.

|

| COL Financial Investment Guide |

Other selection where made when I started to look at First metro securities technical event look up guide where I always make sure I am near the support level price and there are more bullish trends than bearish under the short, intermediate and long term ranges.

|

| firstmetrosec technical event look up |

Lessons

➤check the trend and buy always near the support level being created from the market

On the third month which is July almost at the end of the week I got bored I guess and lazy as well as I simply scout from other websites with their own stock picks or stock recommendations to buy this stock when below this price, just like in COL with its BBP as I make some comparisons.

To be honest it was a disaster! Don't ever commit the same mistake I did from buying from recommendations without confirming from the chart yourself.

Fast forward I did some cut loss and by the 2nd week of October did some purchase of other stocks and by luck was able to recover.

|

| recovery_after_cut_loss |

With my mistake on buying stock recommendations (MBT) I managed to pull out with a gain when I tested the average down method to experience its pros and cons but personally it will take time and not worth it on a diving market.

Lessons:

➤apply cut loss on a down market and never trust tips of what to buy or sell.

➤be patient to wait for another edge to appear before you enter, don't be in a rush.

➤don't average down if the market price is on a dive, will deplete your buy power at hand.

That's how I started earning my ₱11K+ by trading in the stock market as a novice and I do hope you were able to pick up some points or lessons that you may apply, some do's and don'ts when you will start either as a trader or an investor, your choice.

Before you get excited what I have shown you is just my personal journal, your real account is what matters most which is your total equity not what you list as gains on your excel sheet.

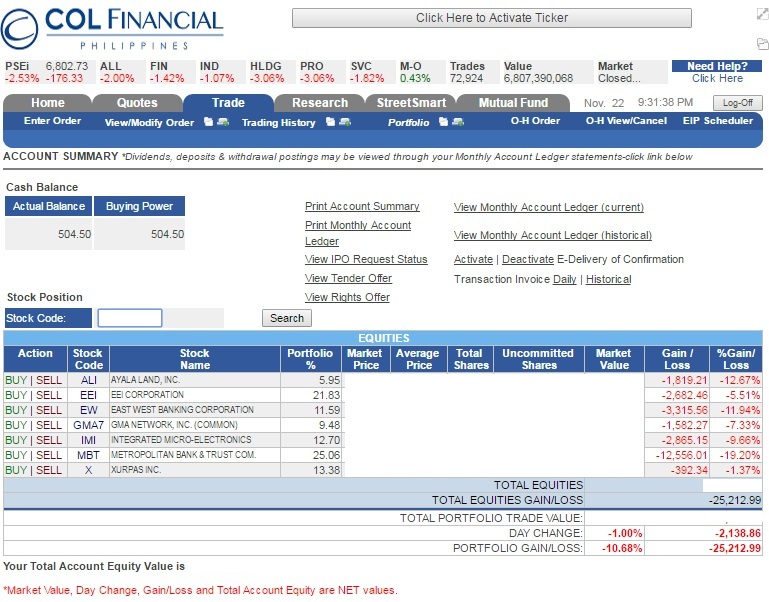

So what happened after those gains from my journal were totally the reverse from my port after making mistakes one after another the coming months. rofl

Before you get excited what I have shown you is just my personal journal, your real account is what matters most which is your total equity not what you list as gains on your excel sheet.

So what happened after those gains from my journal were totally the reverse from my port after making mistakes one after another the coming months. rofl

|

| bloody_port_2016 |

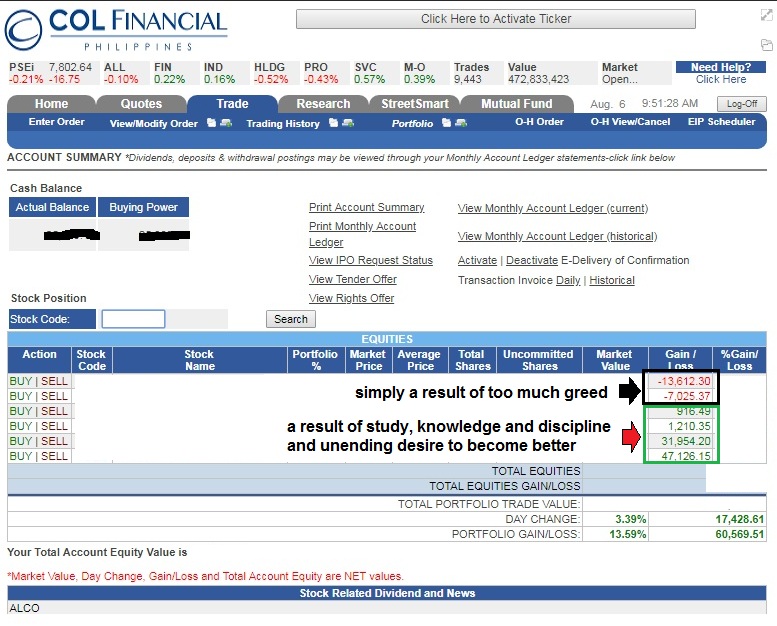

With focus, discipline, and hard work of study I was able to recover and with confidence I already know how to grab the rewards the market has to offer.

|

| Portfolio_2018 |

I believe you can do better than what I did as long as you make your own research and learn from other traders.

Results may vary from each person depending on your risk appetite, and how you will be able to control your emotions in situations which will call for a quick and firm decision without any hesitation like making "cut losses".

So that's just my short story and I do hope you learn something and may you have the discipline with the winning attitude to your stock journey.

It's not about winning your trades with a perfect record but how you manage your "buy power" to absorb some short losses and use that to buyback when opportunity arise.

Set your own goals write it down and just don't look at it rather bring it to life by putting some Action!

If you find this helpful, say thanks by sharing this site to others!

2 Comments

Thanks.I am same like you who has gotten into trading from internet only. Hype in the beginning so i lost already a lot but then how will we improved is to journal your trades and analyze them both winners and loosers. And similarly to you i tried 100k pesos just to test the waters in 2018, so far i lost 20k on that account but then started also just applying the cost averging now to buy every payday. so i have two type of trading/investments long term and also active trading. i am trying to really make this a side hustle now since after 2 years more when i retire i want this to be my source of income during my retirement age.

ReplyDeleteWelcome, well it's true that having a record is a good habit but with 2020 experience such as the pandemic and short trading hours I have a more clearer picture how these whales are making money. Reason why I am rewriting this whole blog to another https://pinoystockcorner.blogspot.com to guide incoming traders.

DeleteFrom experience "cost average" I no longer advise specially if you are holding a losing stock, just imagine those trading JFC at ₱325 before if they continued to make cost average up to now they are simply burning their hard earned money.

Long term as I see in a Bear market will only benefit those big players at the expense of retail traders/investors, that's my own take based from what I observed for the past year.

With your 2 years left to have some source of funds use it wisely when buying stocks and scout stocks from a weekly time frame that have created a strong support just above a MA40 (moving average).

Cut loss, buy back, take profit are big factors to stay alive and never forget your previous major Support and Resistance levels as reference.

Good luck!